Tier 1 Capital Ratio: Definition and Formula for Calculation

Por um escritor misterioso

Last updated 01 junho 2024

:max_bytes(150000):strip_icc()/Tier_1_Capital_Ratio_final_v3-057aabaee3b247228bde4b73c66ae9de.png)

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—its equity capital and disclosed reserves—to its total risk-weighted assets.

What is the Tier 1 Capital Ratio? – SuperfastCPA CPA Review

Quiz & Worksheet - Calculating Working Capital Ratio

Leverage Ratios - Debt/Equity, Debt/Capital, Debt/EBITDA, Examples

Return on Equity, Formula, Ratio & Examples - Video & Lesson Transcript

Tier 1 Capital - The Easy Way to See the Strength of a Bank's Balance Sheet

Identifying an Optimal Level of Capital and Evaluating the Impact of Higher Bank Capital Requirements on US Capital Markets - SIFMA - Identifying an Optimal Level of Capital and Evaluating the Impact

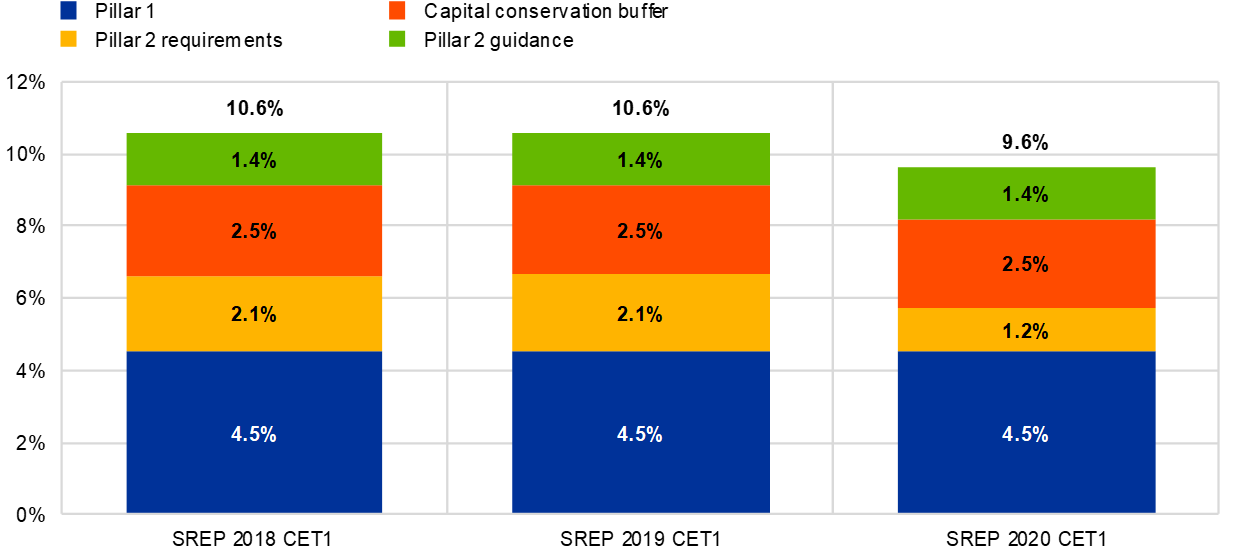

2020 SREP aggregate results

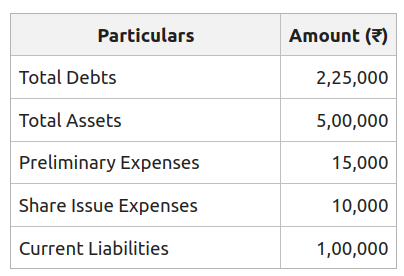

Total Assets to Debt Ratio: Meaning, Formula and Examples - GeeksforGeeks

Gross Margin Ratio Definition and Formula (2023)

Tier 1 Capital - The Easy Way to See the Strength of a Bank's Balance Sheet

Recomendado para você

-

What Is A Tier List In Video Games?01 junho 2024

What Is A Tier List In Video Games?01 junho 2024 -

Mastering English: Understanding Top-Tier Work01 junho 2024

Mastering English: Understanding Top-Tier Work01 junho 2024 -

Tier List: How effective is each DPS is in a generalized setting01 junho 2024

Tier List: How effective is each DPS is in a generalized setting01 junho 2024 -

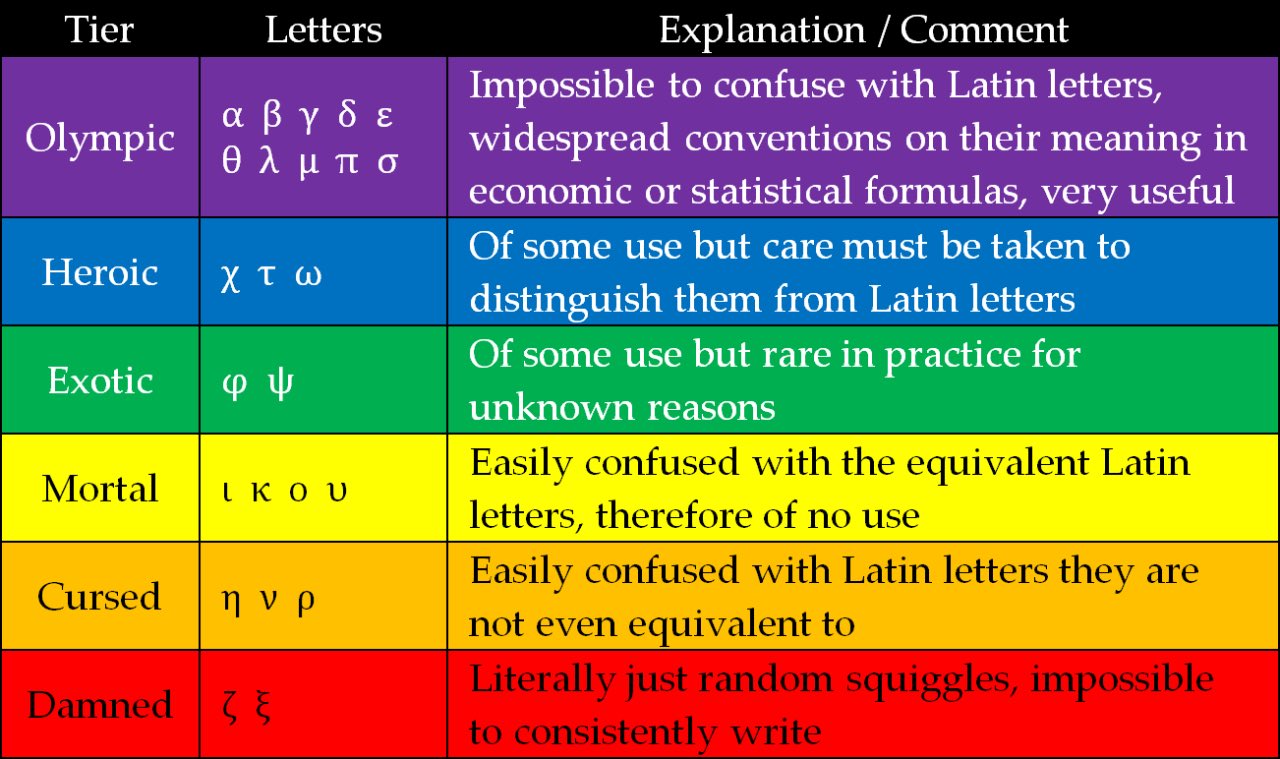

Andrew G. Benson on X: @causalinf Here's my tier list of the01 junho 2024

Andrew G. Benson on X: @causalinf Here's my tier list of the01 junho 2024 -

:max_bytes(150000):strip_icc()/tier1capital.asp_FINAL-9183cdc7ec8b4bd2b230d4ee7af1dec6.png) Tier 1 Capital: Definition, Components, Ratio, and How It's Used01 junho 2024

Tier 1 Capital: Definition, Components, Ratio, and How It's Used01 junho 2024 -

Decoding Top-tier: Elevate Your English01 junho 2024

Decoding Top-tier: Elevate Your English01 junho 2024 -

God Tier: Mathematics / Physics / Chemistry / Astronomy01 junho 2024

God Tier: Mathematics / Physics / Chemistry / Astronomy01 junho 2024 -

Tier 1, 2, & 3 Suppliers Difference Explained01 junho 2024

-

that meaning top tier|TikTok Search01 junho 2024

that meaning top tier|TikTok Search01 junho 2024 -

Top Tier Bakery01 junho 2024

você pode gostar

-

tower of god temporada 2|TikTok Search01 junho 2024

-

Las vegas eua abril 2017 panorama hdri sem costura completo vista de ângulo de 360 graus no cassino vip de luxo de elite interior com mesa de bilhar em estilo verde em01 junho 2024

Las vegas eua abril 2017 panorama hdri sem costura completo vista de ângulo de 360 graus no cassino vip de luxo de elite interior com mesa de bilhar em estilo verde em01 junho 2024 -

Four D-FW properties included in storage center sale01 junho 2024

Four D-FW properties included in storage center sale01 junho 2024 -

MOD CAMBIO STEP1 / H SHIFTER V2 LOGITECH G25 G27 G29 – IMPROVED01 junho 2024

MOD CAMBIO STEP1 / H SHIFTER V2 LOGITECH G25 G27 G29 – IMPROVED01 junho 2024 -

The Great Escape! (The Cuphead Show!) (Step into Reading) (Paperback)01 junho 2024

The Great Escape! (The Cuphead Show!) (Step into Reading) (Paperback)01 junho 2024 -

Young Hugo Weaving in a suit smoking a cigar with a01 junho 2024

Young Hugo Weaving in a suit smoking a cigar with a01 junho 2024 -

IGN - The Last of Us Part I has received “mostly negative” reviews on Steam after the launch of its PC port seems riddled with bugs, crashes, and optimization issues.01 junho 2024

-

Dusttale Sans Fight (android)-Undertale Fangame01 junho 2024

Dusttale Sans Fight (android)-Undertale Fangame01 junho 2024 -

Roblox Todos os gêneros do jogo que é febre01 junho 2024

Roblox Todos os gêneros do jogo que é febre01 junho 2024 -

Guide for A Plague Tale: Innocence - Chapter 4 - The Apprentice01 junho 2024

Guide for A Plague Tale: Innocence - Chapter 4 - The Apprentice01 junho 2024