What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Por um escritor misterioso

Last updated 01 junho 2024

Generation-Skipping Trust (GST): What It Is and How It Works

Publicly traded partnerships: Tax treatment of investors

Are Trust Distributions Taxable? Trust Distribution Taxes Explained - Keystone Law

How Are Trusts Taxed? FAQs - Wealthspire

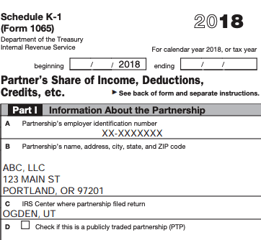

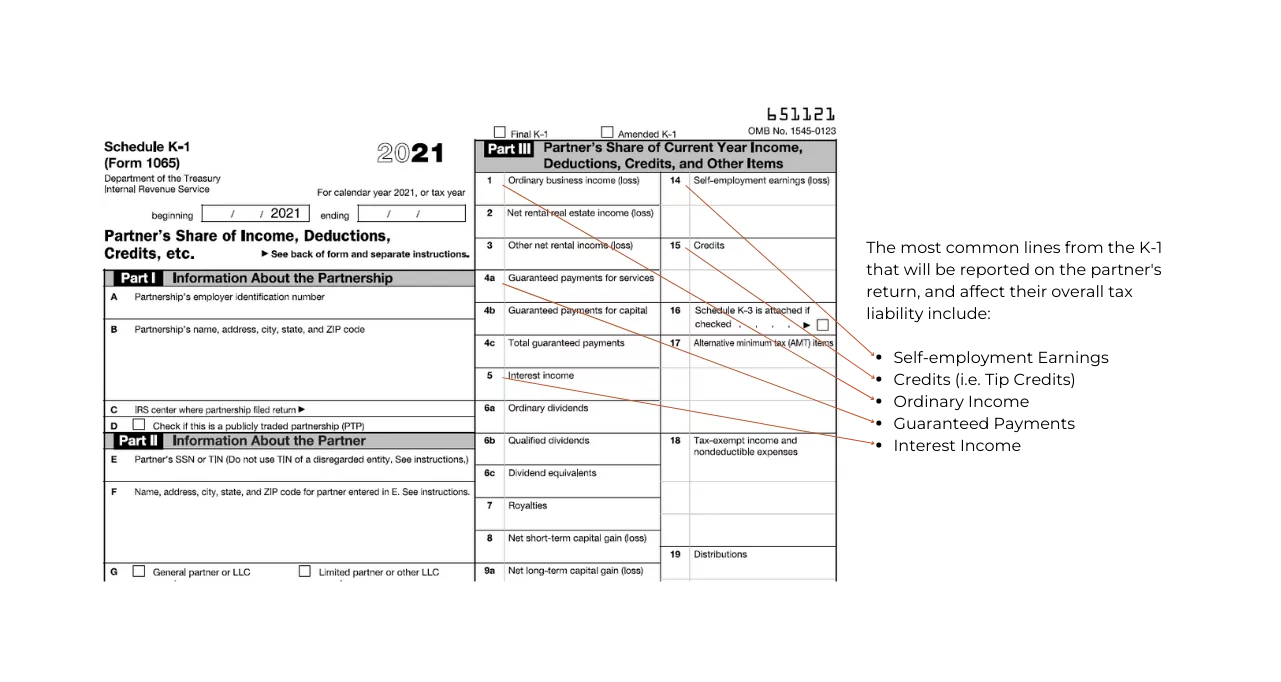

Understanding Your Schedule K-1 and Real Estate Taxes

Income Tax Accounting for Trusts and Estates

Reporting foreign trust and estate distributions to U.S. beneficiaries: Part 3

How Distributions and Profit & Loss Allocations are Taxed - The Fork CPAs

IRS Income Tax Forms: A Checklist for Small Businesses

Selecting the Correct IRS Form 1099-R Box 7 Distribution Codes — Ascensus

Mpls/St. Paul CPAs Premier Tax, Accounting, and Consulting

How to Read and Love a K-1 Tax Form - Actively Passive

Schedule K-1 Instructions: How to Fill Out a K-1 and File It

Tax Implications of Trust and Estate Distributions

Recomendado para você

-

SSS - For Your Own Good Official Track Stream01 junho 2024

SSS - For Your Own Good Official Track Stream01 junho 2024 -

Stream SSS EEE music Listen to songs, albums, playlists for free01 junho 2024

Stream SSS EEE music Listen to songs, albums, playlists for free01 junho 2024 -

Rappler on X: All Social Security System (SSS) branches are open01 junho 2024

Rappler on X: All Social Security System (SSS) branches are open01 junho 2024 -

SSS01 junho 2024

SSS01 junho 2024 -

Disney Pixar Cars 2 Mini Adventures TREV the Train WITH 18 Cars Carrying Case01 junho 2024

Disney Pixar Cars 2 Mini Adventures TREV the Train WITH 18 Cars Carrying Case01 junho 2024 -

File:2022 Porsche Macan S 1X7A0820.jpg - Wikimedia Commons01 junho 2024

File:2022 Porsche Macan S 1X7A0820.jpg - Wikimedia Commons01 junho 2024 -

Refurbished Apple Watch SE (2nd Generation) GPS, 40mm Starlight01 junho 2024

-

Seismology, UPSeis01 junho 2024

Seismology, UPSeis01 junho 2024 -

File:Mercedes-AMG A 45 S 4MATIC+ (W177) 1X7A0312.jpg - Wikipedia01 junho 2024

File:Mercedes-AMG A 45 S 4MATIC+ (W177) 1X7A0312.jpg - Wikipedia01 junho 2024 -

2024 Chevrolet Blazer EV Preview: Electric SUV includes 557-hp SS01 junho 2024

2024 Chevrolet Blazer EV Preview: Electric SUV includes 557-hp SS01 junho 2024

você pode gostar

-

Papel De Parede 3d Dourado, Artesanato, Moderno, Criativo, Não01 junho 2024

Papel De Parede 3d Dourado, Artesanato, Moderno, Criativo, Não01 junho 2024 -

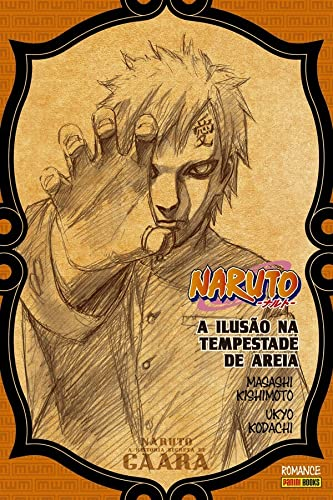

Naruto: A História Secreta de Gaara: A Ilusão Na Tempestade De Areia - Reboot Comic Store01 junho 2024

Naruto: A História Secreta de Gaara: A Ilusão Na Tempestade De Areia - Reboot Comic Store01 junho 2024 -

:strip_icc()/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2022/i/o/i3RZEQRxuPFjFR4Drjtg/montagem-presidenciaveis2.jpg) Você viu? Presidenciáveis no JN, empresários investigados por mensagens de teor golpista, sucessão do Papa, ilha de R$ 23 milhões e a mansão de Belo e Gracyanne, Mundo01 junho 2024

Você viu? Presidenciáveis no JN, empresários investigados por mensagens de teor golpista, sucessão do Papa, ilha de R$ 23 milhões e a mansão de Belo e Gracyanne, Mundo01 junho 2024 -

Super Mario 3D World + Bowser's Fury - Bowser and Bowser. Jr amiibo are compatible, figures will be reprinted01 junho 2024

Super Mario 3D World + Bowser's Fury - Bowser and Bowser. Jr amiibo are compatible, figures will be reprinted01 junho 2024 -

Robin crowned as UK's national bird: It's aggressive, vicious, but01 junho 2024

Robin crowned as UK's national bird: It's aggressive, vicious, but01 junho 2024 -

Códigos para poupar tempo na Netflix e ir direto às subcategorias01 junho 2024

Códigos para poupar tempo na Netflix e ir direto às subcategorias01 junho 2024 -

Asphalt 9 Legends Codes (December 2023): Wonderful Gifts for You! - GamePretty01 junho 2024

Asphalt 9 Legends Codes (December 2023): Wonderful Gifts for You! - GamePretty01 junho 2024 -

Zelda: Link's Awakening developed by Grezzo, Breath of the Wild sequel vs DLC - Perfectly Nintendo01 junho 2024

Zelda: Link's Awakening developed by Grezzo, Breath of the Wild sequel vs DLC - Perfectly Nintendo01 junho 2024 -

15 Most Beautiful Private Islands In The World You Can Rent01 junho 2024

15 Most Beautiful Private Islands In The World You Can Rent01 junho 2024 -

Egito vence Uganda e volta à liderança nas Eliminatórias Africanas - Gazeta Esportiva01 junho 2024

Egito vence Uganda e volta à liderança nas Eliminatórias Africanas - Gazeta Esportiva01 junho 2024