Bona Fide Residence test explained for US expats - 1040 Abroad

Por um escritor misterioso

Last updated 01 junho 2024

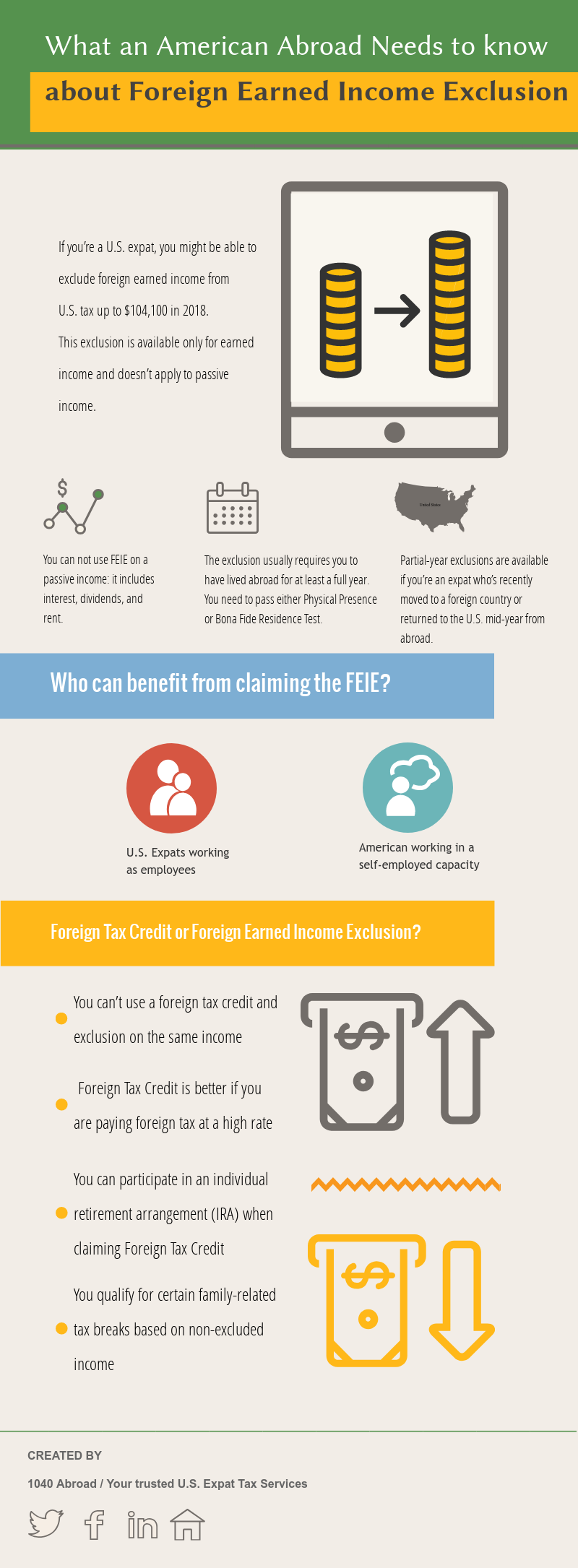

How can US expat qualify for the Foreign Earned Income exclusion? Passing Bona Fide Residence Test and meeting its requirements explained in tax infographic.

foreign earned income exclusion - FasterCapital

What is a Foreign Earned Income for U.S. expats? - 1040 Abroad

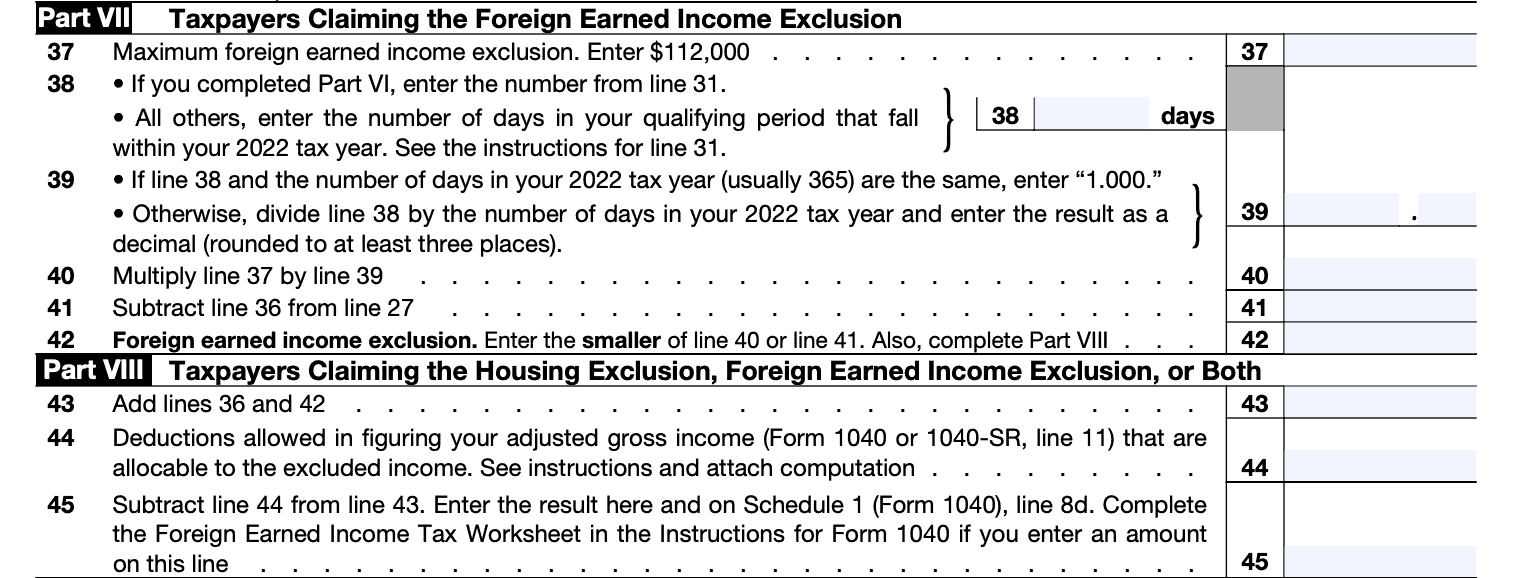

U.S. Expats - Individual Tax Return

What U.S. Expat needs to know about Foreign Earned Income Exclusion, by 1040 Abroad

U.S. Citizens and Resident Aliens Abroad – Automatic 6 Month Extension of Time to File – Easy Milano

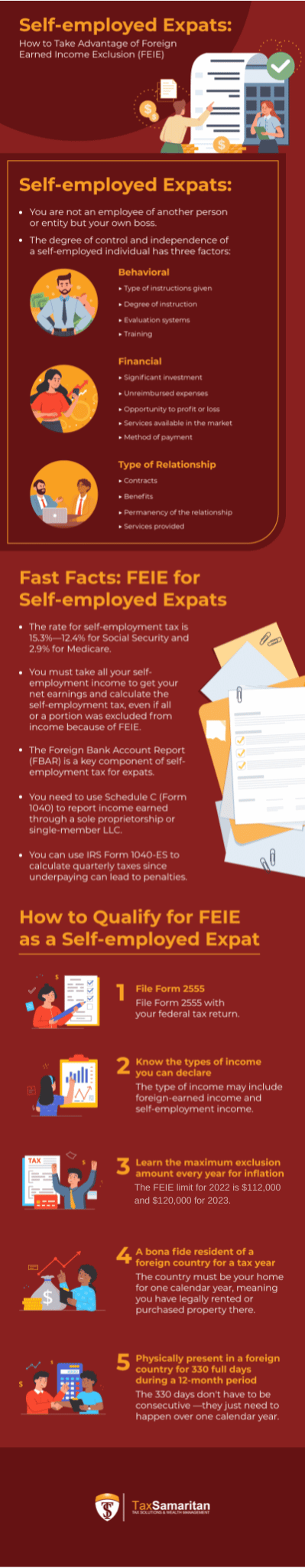

FEIE for Self-Employed Expat: How To Take Advantage

Bona Fide Residence test explained for US expats - 1040 Abroad

21 Things to Know About US Expat Taxes in 2022 - MyExpatTaxes

IRS Form 2555: A Foreign Earned Income Guide

Recomendado para você

-

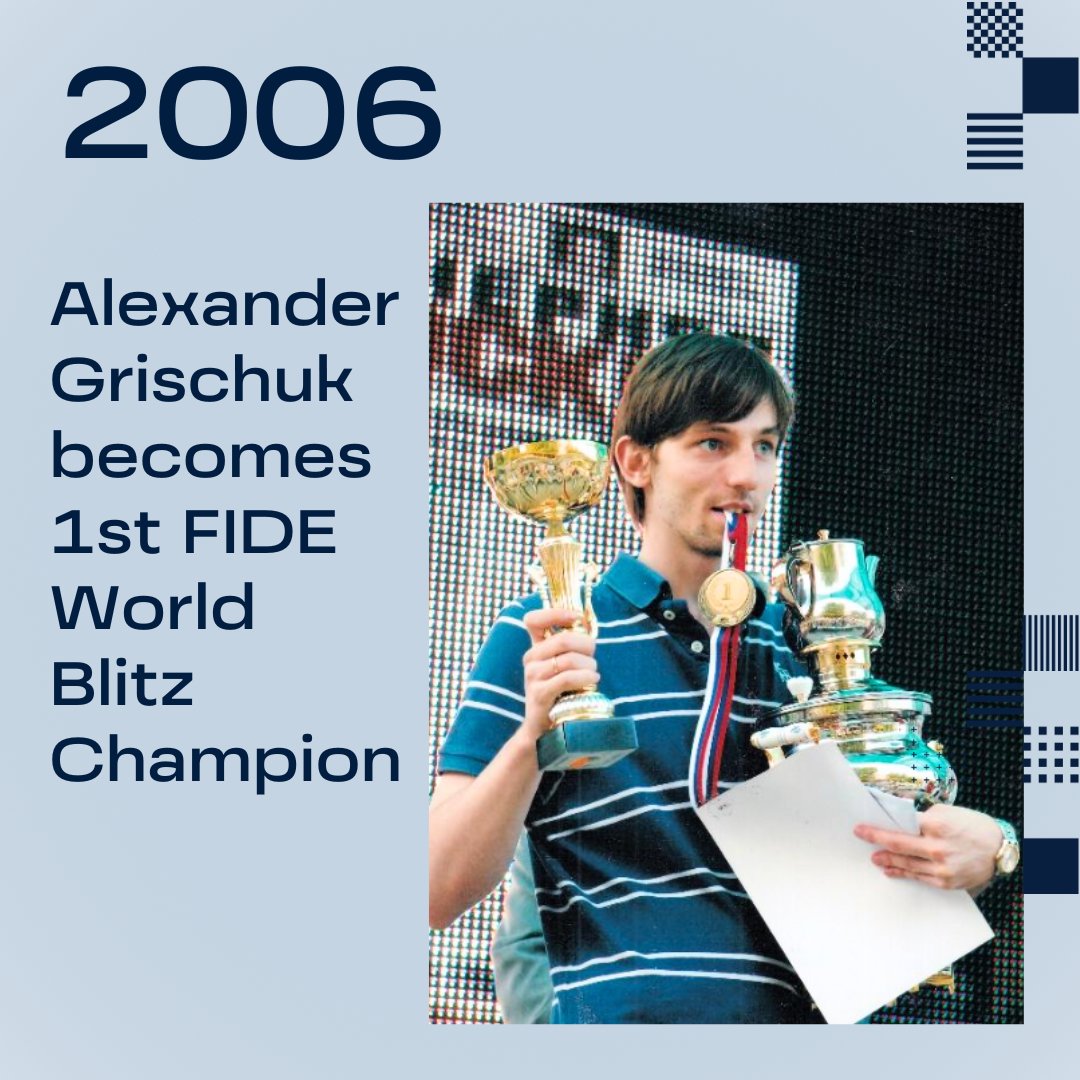

Updated List of Chess FIDE World Cup Winners (2000-2023)01 junho 2024

Updated List of Chess FIDE World Cup Winners (2000-2023)01 junho 2024 -

FIDE Candidates Tournament starts Friday01 junho 2024

FIDE Candidates Tournament starts Friday01 junho 2024 -

FIDE Trainers Seminar – English Chess Federation01 junho 2024

FIDE Trainers Seminar – English Chess Federation01 junho 2024 -

FIDE Online Arena Makes a Move To a New Domain01 junho 2024

FIDE Online Arena Makes a Move To a New Domain01 junho 2024 -

FIDE Online Arena Now Has an iOS App. Hmmm01 junho 2024

FIDE Online Arena Now Has an iOS App. Hmmm01 junho 2024 -

Current list of Qualifiers for FIDE World Cup 2023 – European Chess Union01 junho 2024

Current list of Qualifiers for FIDE World Cup 2023 – European Chess Union01 junho 2024 -

International Chess Federation (@FIDE_chess) / X01 junho 2024

International Chess Federation (@FIDE_chess) / X01 junho 2024 -

FIDE Tornelo01 junho 2024

FIDE Tornelo01 junho 2024 -

Round 2 FIDE World Youth Chess Championships 202301 junho 2024

Round 2 FIDE World Youth Chess Championships 202301 junho 2024 -

World Championship Chess Pieces Set 3.75 Official FIDE Approved type Chess set01 junho 2024

World Championship Chess Pieces Set 3.75 Official FIDE Approved type Chess set01 junho 2024

você pode gostar

-

Five nights at Freddy's 4 - Yamimash edition by CKibe on DeviantArt01 junho 2024

Five nights at Freddy's 4 - Yamimash edition by CKibe on DeviantArt01 junho 2024 -

Reliving your childhood without backwards compatibility : r01 junho 2024

Reliving your childhood without backwards compatibility : r01 junho 2024 -

Little Alchemy : Alexa Skills01 junho 2024

Little Alchemy : Alexa Skills01 junho 2024 -

900+ melhor ideia de Pokemon fofo pokemon fofo, pokemon, pokémon01 junho 2024

900+ melhor ideia de Pokemon fofo pokemon fofo, pokemon, pokémon01 junho 2024 -

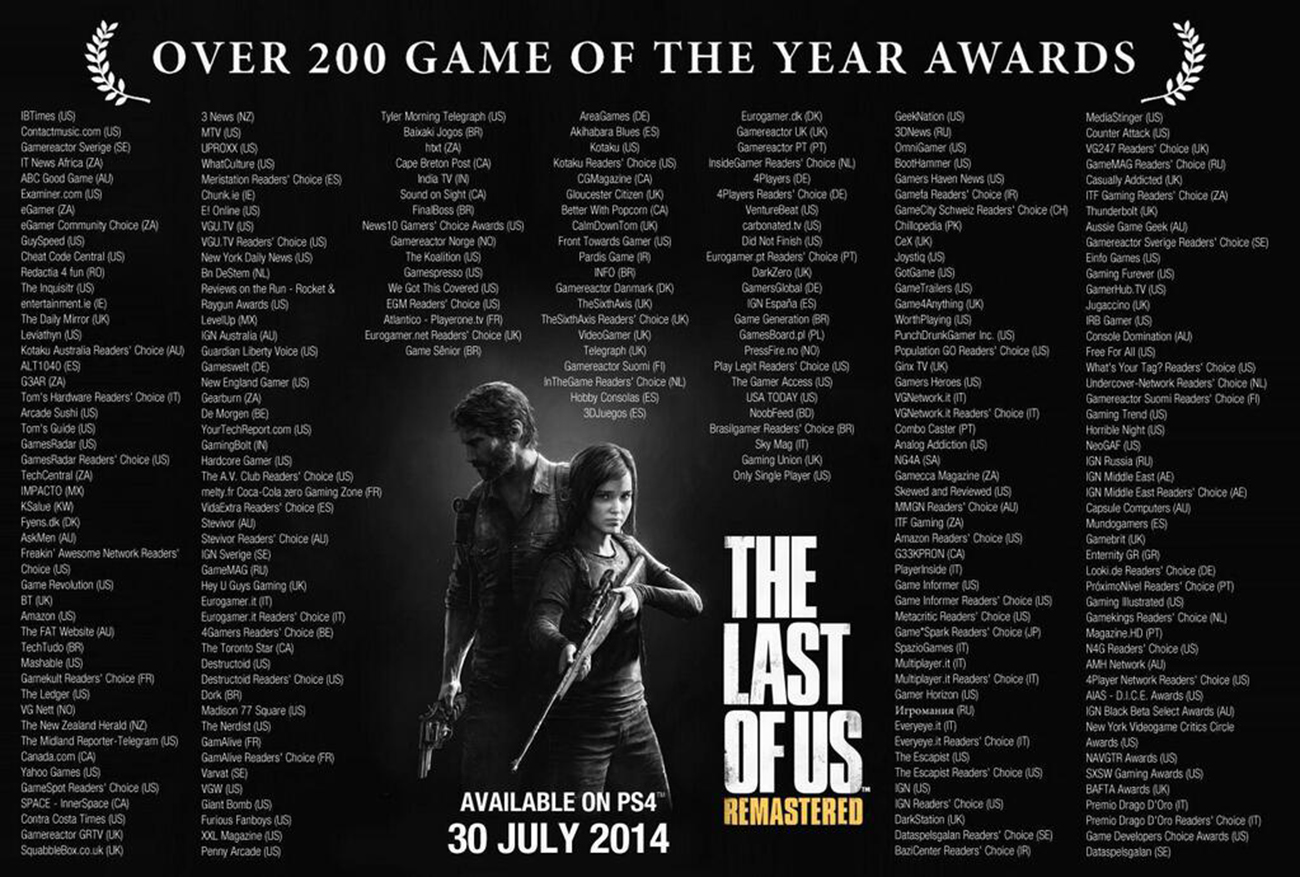

Imagem lista prêmios de Melhor do Ano conquistados por The Last of Us01 junho 2024

Imagem lista prêmios de Melhor do Ano conquistados por The Last of Us01 junho 2024 -

TáG Áftér Schóol Advíce 2023 android iOS apk download for free-TapTap01 junho 2024

TáG Áftér Schóol Advíce 2023 android iOS apk download for free-TapTap01 junho 2024 -

Garden cress: nutrition facts and health benefits - Nutrition and Innovation01 junho 2024

Garden cress: nutrition facts and health benefits - Nutrition and Innovation01 junho 2024 -

Kuroshitsuji (filme) – Wikipédia, a enciclopédia livre01 junho 2024

Kuroshitsuji (filme) – Wikipédia, a enciclopédia livre01 junho 2024 -

Overlord III Folder Icon by kimzetroc on DeviantArt01 junho 2024

Overlord III Folder Icon by kimzetroc on DeviantArt01 junho 2024 -

Play Crazy Shooters Free Online Games. KidzSearch.com01 junho 2024

Play Crazy Shooters Free Online Games. KidzSearch.com01 junho 2024