Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 31 outubro 2024

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

:max_bytes(150000):strip_icc()/freelancer.aspfinal-735c7be9a7d642eabcafa5a0117e4823.jpg)

What Is a Freelancer: Examples, Taxes, Benefits, and Drawbacks

How to Pay Tax As an Independent Contractor or Freelancer

Guide to Taxes for Independent Contractors (2023)

Employee misclassification penalties: Examples and protections

:max_bytes(150000):strip_icc()/gig-economy-final-e11918cb36e74a7db354bf0bf519c12e.jpg)

Gig Economy: Definition, Factors Behind It, Critique & Gig Work

Free Subcontractor Agreement Templates - PDF

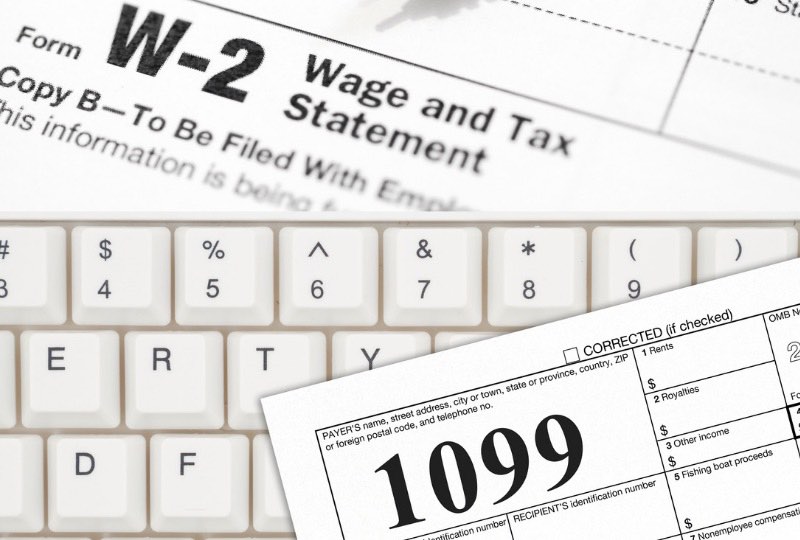

What's the Difference Between W-2, 1099, and Corp-to-Corp Workers?

:max_bytes(150000):strip_icc()/california-assembly-bill-5-ab5-4773201-final-5dededce82a84362b2c83cbebb18abcd.png)

California Assembly Bill 5 (AB5): What's In It and What It Means

How to hire an independent contractor: Vetting, payment, and

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide for Independent Contractors

How to Pay 1099 Contractors?

Recomendado para você

-

Rules of the Internet Meaning & Origin31 outubro 2024

Rules of the Internet Meaning & Origin31 outubro 2024 -

Kaitlin B Curtice on X: @TrentonLucas10 @JustinDGentry Nope. Here's the urban dictionary definition, basically social/political awareness. / X31 outubro 2024

Kaitlin B Curtice on X: @TrentonLucas10 @JustinDGentry Nope. Here's the urban dictionary definition, basically social/political awareness. / X31 outubro 2024 -

this wea munyun came from fr😂 #munyun #slang #viral #fyp #fypシ31 outubro 2024

-

Enterprise resource planning - Wikipedia31 outubro 2024

Enterprise resource planning - Wikipedia31 outubro 2024 -

fanfiction Meaning Pop Culture by31 outubro 2024

fanfiction Meaning Pop Culture by31 outubro 2024 -

Appropriations - Itohan Osayimwese - Rewriting Hermann Frobenius on Architecture in Sub-Saharan Africa31 outubro 2024

Appropriations - Itohan Osayimwese - Rewriting Hermann Frobenius on Architecture in Sub-Saharan Africa31 outubro 2024 -

Drawing Attention - the Urban Sketchers zine, June 2022 by Drawing Attention - Issuu31 outubro 2024

Drawing Attention - the Urban Sketchers zine, June 2022 by Drawing Attention - Issuu31 outubro 2024 -

![I found this on urban dictionary and thought it would make sense here [KABT, urban dictionary] : r/menwritingwomen](https://preview.redd.it/w9jlkgn3z5h71.png?auto=webp&s=2a6c88900c920f33e42dbbbfc4c96c3531eaab9e) I found this on urban dictionary and thought it would make sense here [KABT, urban dictionary] : r/menwritingwomen31 outubro 2024

I found this on urban dictionary and thought it would make sense here [KABT, urban dictionary] : r/menwritingwomen31 outubro 2024 -

China - Wikipedia31 outubro 2024

China - Wikipedia31 outubro 2024 -

Rule 63 Know Your Meme31 outubro 2024

Rule 63 Know Your Meme31 outubro 2024

você pode gostar

-

You said you like cat girls right?31 outubro 2024

You said you like cat girls right?31 outubro 2024 -

lookaside.fbsbx.com/lookaside/crawler/media/?media31 outubro 2024

-

The Walten Files' Creator Martin Walls Talks About The Viral Series, Animatronic Horror And The Most Emotional Scene He Ever Animated31 outubro 2024

The Walten Files' Creator Martin Walls Talks About The Viral Series, Animatronic Horror And The Most Emotional Scene He Ever Animated31 outubro 2024 -

fnf x pibby corrupted Gumball but with darwin by 1Pororo on DeviantArt31 outubro 2024

fnf x pibby corrupted Gumball but with darwin by 1Pororo on DeviantArt31 outubro 2024 -

How to Start a VRBO Property and Financing Options - Biz2Credit31 outubro 2024

How to Start a VRBO Property and Financing Options - Biz2Credit31 outubro 2024 -

stumble guys xbox|Pesquisa do TikTok31 outubro 2024

-

Steam Workshop::Funtime Chica - FNAF 631 outubro 2024

-

Bleach - Dublado – Episódio 295 Online - Hinata Soul31 outubro 2024

Bleach - Dublado – Episódio 295 Online - Hinata Soul31 outubro 2024 -

HD roblox rosado wallpapers31 outubro 2024

HD roblox rosado wallpapers31 outubro 2024 -

Rockstar Pure Zero Sugar Free Energy Drink Variety (16 fl. oz., 2431 outubro 2024