Original Issue Discount (OID): Formula, Uses, and Examples

Por um escritor misterioso

Last updated 01 junho 2024

:max_bytes(150000):strip_icc()/oid.asp-Final-471a687a904e432f9e8b7927385b4c21.png)

An original issue discount (OID) is the amount of discount or the difference between the original face value and the price paid for the bond.

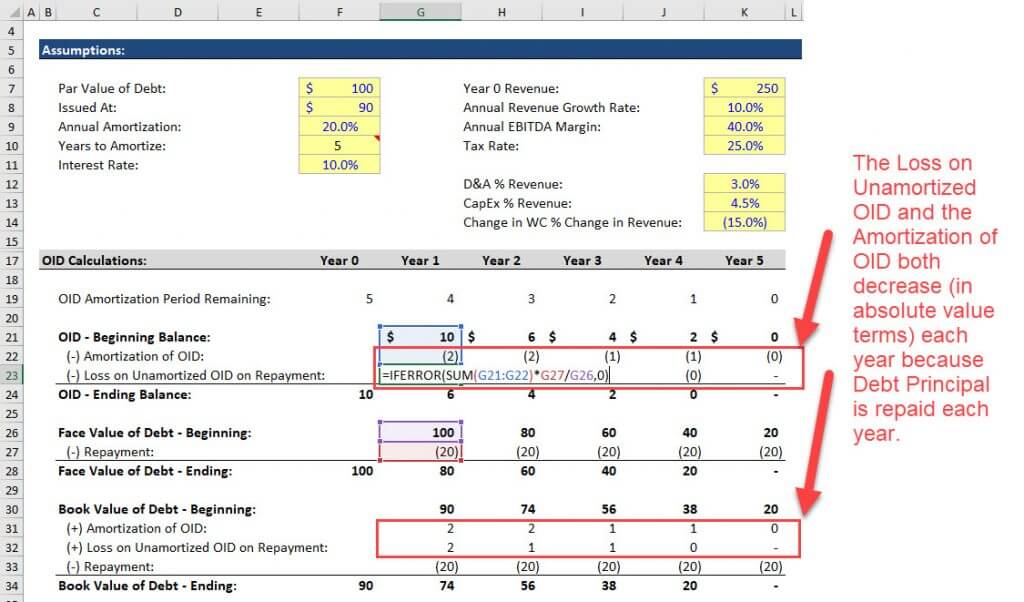

Original Issue Discount Debt (OID) on Bonds - Full Tutorial

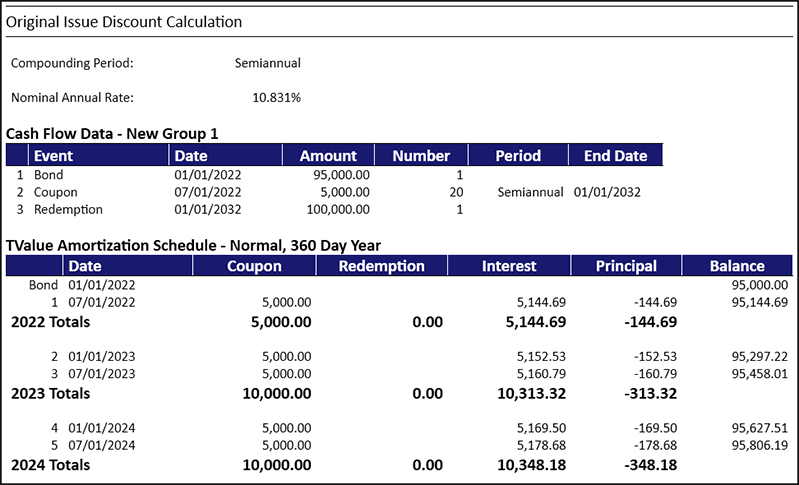

OID (Original Issue Discount) Constant Yield Method

Final Term Sheet

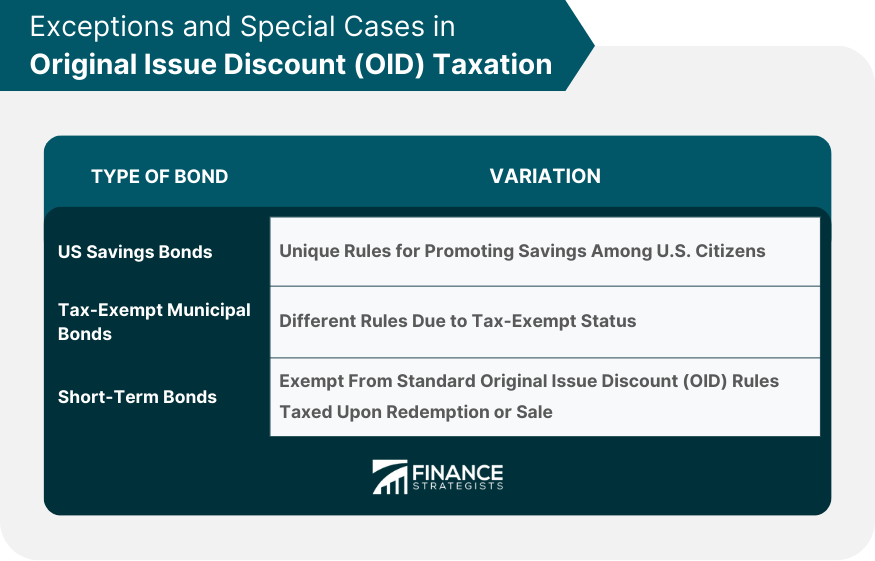

Original Issue Discount (OID) Meaning, Mechanics, Implications

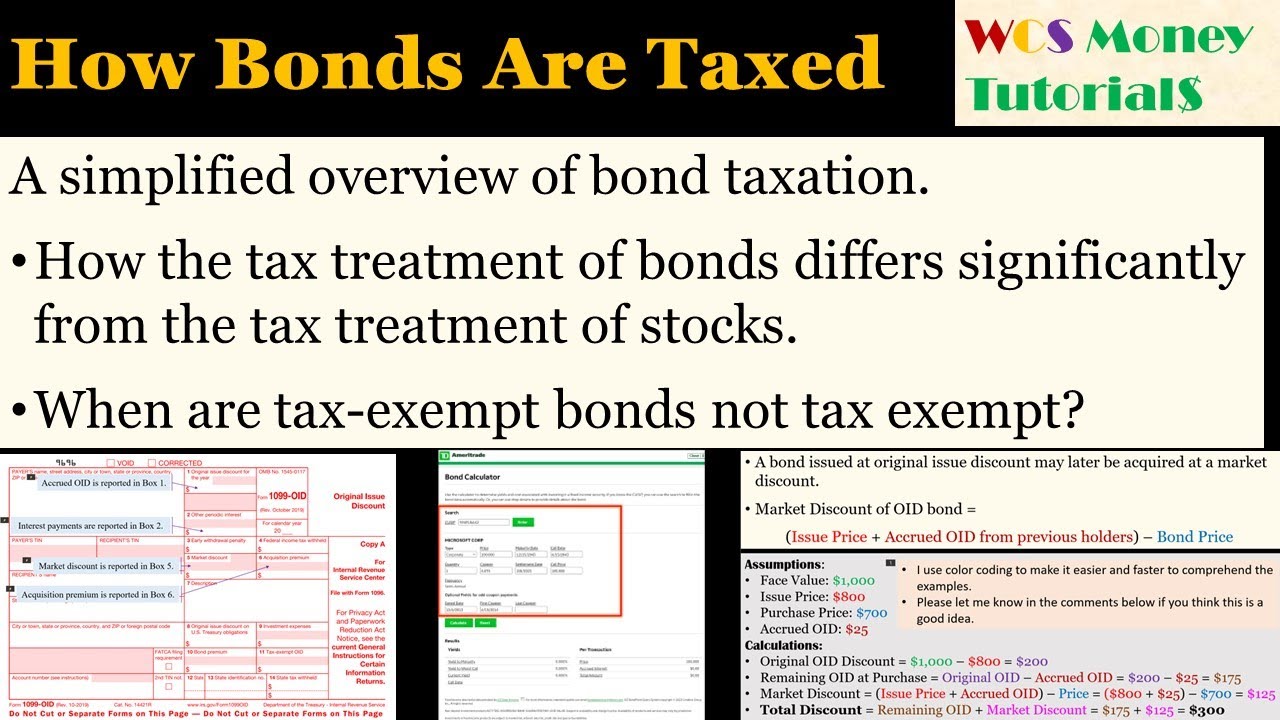

Bond Taxation: A Simplified, Conceptual Overview of Bond Taxation

:max_bytes(150000):strip_icc()/INV-accumulation-bond-4202138-final-f087b9d12d2a4283b0c1b40ed35a718c.jpg)

Accumulation Bond: Meaning, Pros and Cons, Example

Tax implications: Navigating the Tax Landscape of Zero Coupon Bonds - FasterCapital

What is an Original Issue Discount (OID)? - Robinhood

Q&A on TIPS Treasury Inflation-Protected Securities

Original Issue Discount (OID)

OID (Original Issue Discount) Constant Yield Method

Tax implications: Navigating the Tax Landscape of Zero Coupon Bonds - FasterCapital

Original Issue Discount (OID) on Debt Issuances

Recomendado para você

-

Colored Button With Banner 100 % Original Royalty Free SVG, Cliparts, Vectors, and Stock Illustration. Image 41826651.01 junho 2024

Colored Button With Banner 100 % Original Royalty Free SVG, Cliparts, Vectors, and Stock Illustration. Image 41826651.01 junho 2024 -

Refreshingly Original01 junho 2024

-

Cerveja Original Lata 350ml - Supermercado Coop01 junho 2024

-

Velveeta Original Melting Cheese Dip & Sauce, 16 Oz Block01 junho 2024

Velveeta Original Melting Cheese Dip & Sauce, 16 Oz Block01 junho 2024 -

Philadelphia Original Brick Cream Cheese01 junho 2024

-

STARZ - Captivating Original Series. Hit Movies. Bold Storytelling.01 junho 2024

STARZ - Captivating Original Series. Hit Movies. Bold Storytelling.01 junho 2024 -

The Original Sandwich: Nutrition & Ingredients01 junho 2024

The Original Sandwich: Nutrition & Ingredients01 junho 2024 -

Original grunge retro red isolated ribbon stamp Stock Vector by ©Aquir014b 7117869501 junho 2024

Original grunge retro red isolated ribbon stamp Stock Vector by ©Aquir014b 7117869501 junho 2024 -

Original 21 - Wikipedia01 junho 2024

Original 21 - Wikipedia01 junho 2024 -

Originals01 junho 2024

você pode gostar

-

Candy Connect Game: Free Online Fullscreen Candies Mahjong Connect Video Game With No App Download Required01 junho 2024

Candy Connect Game: Free Online Fullscreen Candies Mahjong Connect Video Game With No App Download Required01 junho 2024 -

IPLAY GAMES, Emporium Wicker Park01 junho 2024

IPLAY GAMES, Emporium Wicker Park01 junho 2024 -

Beet mewing before and afters #fyp #mewing #jawline, Jawline01 junho 2024

-

GRANDE DUELO NO MORUMBI, JOGO CONDENSADO01 junho 2024

GRANDE DUELO NO MORUMBI, JOGO CONDENSADO01 junho 2024 -

How to Draw Your ROBLOX Avatar (2 WAYS!)01 junho 2024

How to Draw Your ROBLOX Avatar (2 WAYS!)01 junho 2024 -

An 800 mm Schwerer Gustav shell at the Imperial War Museum…01 junho 2024

An 800 mm Schwerer Gustav shell at the Imperial War Museum…01 junho 2024 -

Penkaru on X: An update on where indie cross has been + the01 junho 2024

Penkaru on X: An update on where indie cross has been + the01 junho 2024 -

Enzo Fernández: conheça promessa da Argentina na Copa - 26/11/202201 junho 2024

Enzo Fernández: conheça promessa da Argentina na Copa - 26/11/202201 junho 2024 -

Everything to Know About the Sales Incentives01 junho 2024

Everything to Know About the Sales Incentives01 junho 2024 -

My Life As 5-in-1 Game Play Set for 18 Doll, 44 Pieces01 junho 2024

My Life As 5-in-1 Game Play Set for 18 Doll, 44 Pieces01 junho 2024