How to Claim Entrepreneurs Relief in a Members Voluntary Liquidation

Por um escritor misterioso

Last updated 23 maio 2024

Suppose you are closing a solvent business through a Members’ Voluntary Liquidation (MVL) process and selling the business’s assets. In that case, you will be liable to pay Capital Gains Tax (CGT) on the profits of all qualifying assets that are sold. However, you may be eligible for tax relief on CGT, which was called

What is a Members' Voluntary Liquidation (MVL)? - Real Business Rescue

What is Entrepreneurs' Relief and when you should claim it

A guide to members' voluntary liquidation (MVL)

Members Voluntary Liquidation / Solvent Liquidations - Some Tips From Smart Business Recovery - Steven Mather Solicitor

Members Voluntary Liquidation (MVL): a Guide

Exiting your business using a Members' Voluntary Liquidation

Providing for Your Future

Business Asset Disposal Relief: Everything You Need to Know in 2020

Members Voluntary Liquidation (MVL): Get A Free Consultation

Entrepreneurial & Retirement Relief

Recomendado para você

-

MVL: The 2020 Candidates is extremely crucial for me23 maio 2024

MVL: The 2020 Candidates is extremely crucial for me23 maio 2024 -

Alekseenko's Candidates Participation Confirmed As MVL Appeals With Open Letter23 maio 2024

Alekseenko's Candidates Participation Confirmed As MVL Appeals With Open Letter23 maio 2024 -

MVL on being Carlsen's no. 1 rival in blitz23 maio 2024

MVL on being Carlsen's no. 1 rival in blitz23 maio 2024 -

Vachier-Lagrave: Mvl Wins, Indians Falter23 maio 2024

Vachier-Lagrave: Mvl Wins, Indians Falter23 maio 2024 -

MVL price today, MVL to USD live price, marketcap and chart23 maio 2024

MVL price today, MVL to USD live price, marketcap and chart23 maio 2024 -

Neztor MVL (@neztormvloficial) • Instagram photos and videos23 maio 2024

-

Momentum, MVL-25/25M23 maio 2024

Momentum, MVL-25/25M23 maio 2024 -

Welcome to MVL - MVLChain23 maio 2024

Welcome to MVL - MVLChain23 maio 2024 -

MVL Vector Logo - Download Free SVG Icon23 maio 2024

-

The MVL Store23 maio 2024

você pode gostar

-

chess24 - World Chess Champion Magnus Carlsen scored 14.5/15 in his latest Banter Blitz session! Replay all the games with Magnus' commentary and computer analysis23 maio 2024

-

Assassin's Creed III Remastered23 maio 2024

Assassin's Creed III Remastered23 maio 2024 -

jogo dawn of mana ps2 original Novo Lacrado! - esquare enix23 maio 2024

jogo dawn of mana ps2 original Novo Lacrado! - esquare enix23 maio 2024 -

Empoli, Italy. 21st Aug, 2022. Domilson Cordeiro dos Santos Dodo (ACF Fiorentina) during Empoli FC vs ACF Fiorentina, italian soccer Serie A match in Empoli, Italy, August 21 2022 Credit: Independent Photo23 maio 2024

Empoli, Italy. 21st Aug, 2022. Domilson Cordeiro dos Santos Dodo (ACF Fiorentina) during Empoli FC vs ACF Fiorentina, italian soccer Serie A match in Empoli, Italy, August 21 2022 Credit: Independent Photo23 maio 2024 -

Dwayne Johnson Movies in Chronological Order - IMDb23 maio 2024

Dwayne Johnson Movies in Chronological Order - IMDb23 maio 2024 -

O*net online: onetonline.org is a great resource for career exploration. It includes information on amount of…23 maio 2024

O*net online: onetonline.org is a great resource for career exploration. It includes information on amount of…23 maio 2024 -

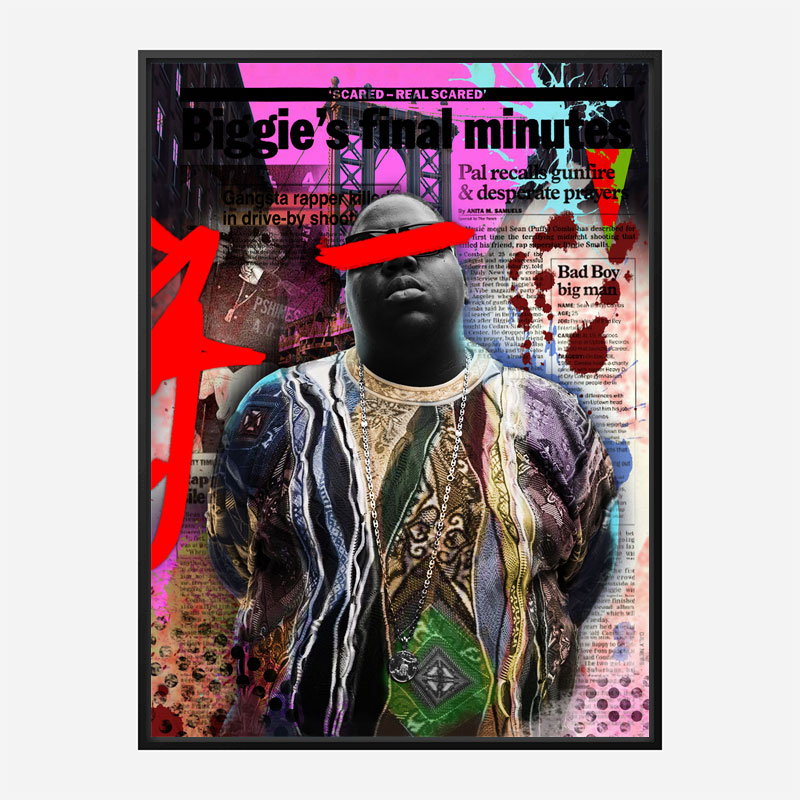

Biggie Smalls Art Print23 maio 2024

Biggie Smalls Art Print23 maio 2024 -

My ALMOST Perfect day in Papa's Donuteria23 maio 2024

My ALMOST Perfect day in Papa's Donuteria23 maio 2024 -

Jogo De Xadrez. Conceito De Estratégia De Negócios E Tático. Foto Royalty Free, Gravuras, Imagens e Banco de fotografias. Image 19431158523 maio 2024

Jogo De Xadrez. Conceito De Estratégia De Negócios E Tático. Foto Royalty Free, Gravuras, Imagens e Banco de fotografias. Image 19431158523 maio 2024 -

Cristiano Ronaldo brilha em virada do Al Nassr e conquista seu primeiro título na Arábia Saudita23 maio 2024

Cristiano Ronaldo brilha em virada do Al Nassr e conquista seu primeiro título na Arábia Saudita23 maio 2024