Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 03 junho 2024

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

Value-Added Tax (VAT): Definition, Who Pays - NerdWallet

UK 50th Birthday Newspaper Poster 1973 Newspaper Poster 50

The rise of high-tax Britain - New Statesman

A Comparative Analysis of the VAT System of Developed and Developing Economies (UK and Nigeria)

Estimating the repercussions from China's export value‐added tax rebate policy* - Gourdon - 2022 - The Scandinavian Journal of Economics - Wiley Online Library

Taxation in the Republic of Ireland - Wikipedia

VAT reliefs for disabled and older people

HMRC tax receipts and National Insurance contributions for the UK (annual bulletin)

Breaking Down The Impact Of UK's Value Added Tax On Sellers

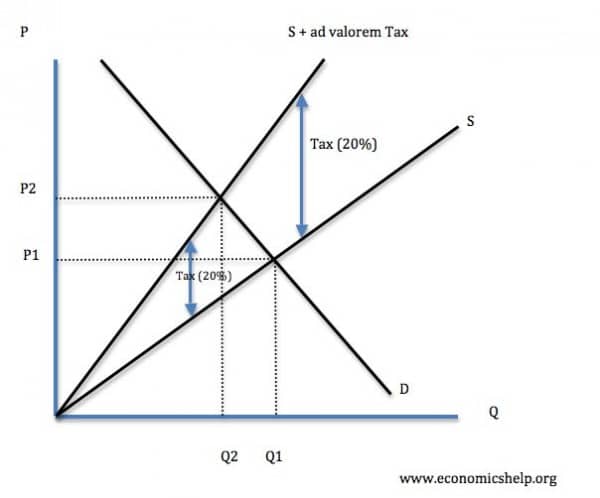

Ad valorem tax - Economics Help

VAT between the UK and the US

How to handle value-added tax (VAT)

Value-added tax - Wikipedia

Recomendado para você

-

offers free 'online shop window' for SMEs during lockdown - Toy World Magazine, The business magazine with a passion for toysToy World Magazine03 junho 2024

offers free 'online shop window' for SMEs during lockdown - Toy World Magazine, The business magazine with a passion for toysToy World Magazine03 junho 2024 -

Top selling stuff on UK03 junho 2024

-

Offers Authenticity Guarantee For Luxury Watches In The UK03 junho 2024

Offers Authenticity Guarantee For Luxury Watches In The UK03 junho 2024 -

How to Sell on : 17 Selling tips for UK - Full Fees Calculator03 junho 2024

How to Sell on : 17 Selling tips for UK - Full Fees Calculator03 junho 2024 -

.co.uk03 junho 2024

-

promotes marketing chief Eve Williams to UK boss03 junho 2024

promotes marketing chief Eve Williams to UK boss03 junho 2024 -

UK is 15-years-old: Here's the top 15 weirdest listings ever03 junho 2024

UK is 15-years-old: Here's the top 15 weirdest listings ever03 junho 2024 -

New Apple iPhone 11 64GB Purple MWLX2B/A LTE 4G Sim Free Unlocked03 junho 2024

New Apple iPhone 11 64GB Purple MWLX2B/A LTE 4G Sim Free Unlocked03 junho 2024 -

Guide to Setting Up an Business Account03 junho 2024

Guide to Setting Up an Business Account03 junho 2024 -

recouples with Love Island as series fashion sponsor03 junho 2024

recouples with Love Island as series fashion sponsor03 junho 2024

você pode gostar

-

Online Games Real Money India - Top, Best University in Jaipur, Rajasthan03 junho 2024

Online Games Real Money India - Top, Best University in Jaipur, Rajasthan03 junho 2024 -

Imposter Mommy Long Legs Source Code - SellAnyCode03 junho 2024

Imposter Mommy Long Legs Source Code - SellAnyCode03 junho 2024 -

Hitman: Contracts03 junho 2024

Hitman: Contracts03 junho 2024 -

انمي Onmyouji الحلقة 4 مترجمة اون لاين03 junho 2024

انمي Onmyouji الحلقة 4 مترجمة اون لاين03 junho 2024 -

Kit 2 Arquivos de corte Silhouette Léo o Caminhão e outro03 junho 2024

Kit 2 Arquivos de corte Silhouette Léo o Caminhão e outro03 junho 2024 -

.png) Xadrez Potiguar03 junho 2024

Xadrez Potiguar03 junho 2024 -

Back-to-School Boss - Chapter 21 - MANHWATOP03 junho 2024

Back-to-School Boss - Chapter 21 - MANHWATOP03 junho 2024 -

Buy Gears of War Remastered Collection Other03 junho 2024

Buy Gears of War Remastered Collection Other03 junho 2024 -

TiviMate Companion - Apps on Google Play03 junho 2024

-

otakushopp (@milimnava33)03 junho 2024