Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Last updated 27 setembro 2024

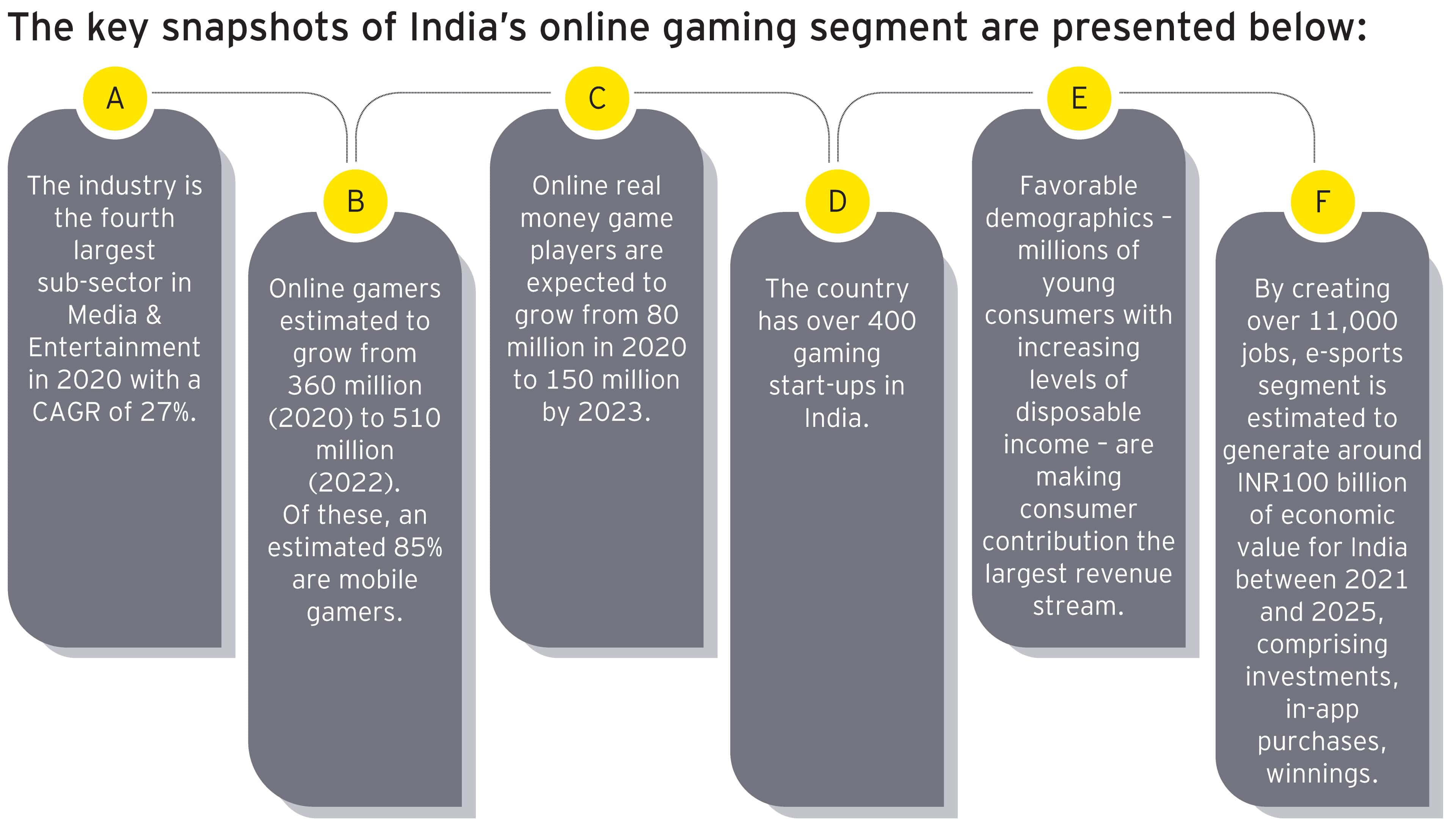

28% GST on online gaming: India Inc fears new taxation could nip the nascent sector

cbic: Online gaming companies tax demand in line with legal stand: CBIC chairman - The Economic Times

GST Inclusive and Exclusive: Definition, Difference, & Calculation, by Moon Invoice — Easy Invoicing

GST on actionable claims: an area of rising litigation in India

CBDT notifies CGST (Third Amendment) Rules, 2023

Online gaming in India – the GST connundrum

GST Council Recommends GST on Valuation of Supply of Online Gaming & Actionable Claims in Casinos at Entry Level

Online gaming in India – the GST connundrum

Revised GST Slab Rates in India F.Y. 2023-24 by Council

How To Value Supplies in Online Gaming and Casino: GST Implications

Recomendado para você

-

Free Online Games - Play-on-line.co.uk27 setembro 2024

-

All in one Game, All Games - Apps on Google Play27 setembro 2024

-

How To Enjoy the Best of The Online Gaming World27 setembro 2024

How To Enjoy the Best of The Online Gaming World27 setembro 2024 -

Best Free Online Games Where Most Indian Play27 setembro 2024

Best Free Online Games Where Most Indian Play27 setembro 2024 -

Free Games Play Free Online Games27 setembro 2024

Free Games Play Free Online Games27 setembro 2024 -

Top 12 New Online Multiplayer Games for Android YOU MUST PLAY27 setembro 2024

Top 12 New Online Multiplayer Games for Android YOU MUST PLAY27 setembro 2024 -

11 Online Games For Virtual Gatherings, by Kevin Lin27 setembro 2024

11 Online Games For Virtual Gatherings, by Kevin Lin27 setembro 2024 -

online games - Y2W Tech Revue27 setembro 2024

online games - Y2W Tech Revue27 setembro 2024 -

How to Use Online Games and Activities to Connect to Grandchildren - WSJ27 setembro 2024

How to Use Online Games and Activities to Connect to Grandchildren - WSJ27 setembro 2024 -

Intramural Online Games Registration27 setembro 2024

Intramural Online Games Registration27 setembro 2024

você pode gostar

-

How to Get The King Justice Skin (Tutorial) (EvoWorld.io)27 setembro 2024

How to Get The King Justice Skin (Tutorial) (EvoWorld.io)27 setembro 2024 -

Disney Cruise Line -- The Disney Wish Cruise Ship27 setembro 2024

Disney Cruise Line -- The Disney Wish Cruise Ship27 setembro 2024 -

CDJapan : Otome Game no Hametsu Flag Shikanai Akuyaku Reijo ni Tensei Shite Shimatta Official Anthology Comic: Sweet Memories - (ID Comics / ZERO-SUM Comics) Anthology BOOK27 setembro 2024

CDJapan : Otome Game no Hametsu Flag Shikanai Akuyaku Reijo ni Tensei Shite Shimatta Official Anthology Comic: Sweet Memories - (ID Comics / ZERO-SUM Comics) Anthology BOOK27 setembro 2024 -

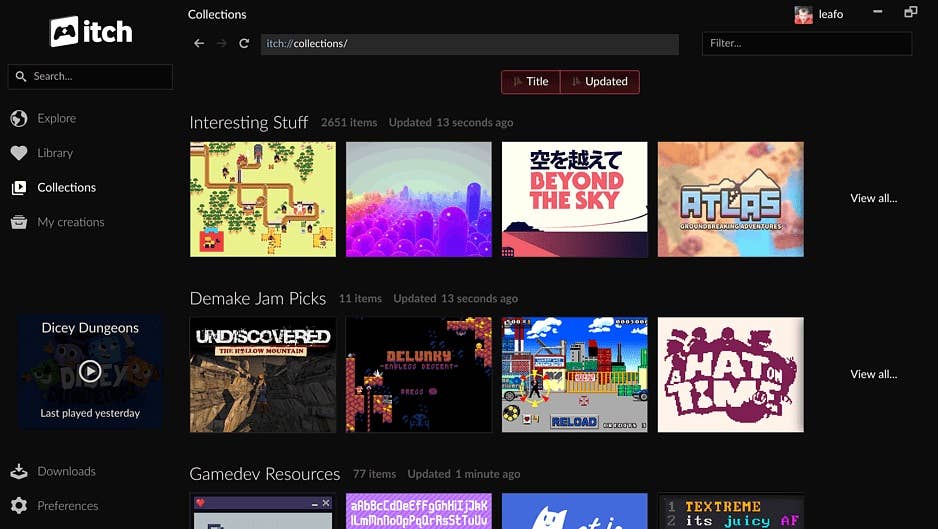

Epic Games Store has added a better game store, Itch.io27 setembro 2024

Epic Games Store has added a better game store, Itch.io27 setembro 2024 -

Estúdio Folha - Nelson Wilians27 setembro 2024

Estúdio Folha - Nelson Wilians27 setembro 2024 -

Pokemon Let's Go Fortune Teller guide: how to use the nature lady to influence Pokemon natures27 setembro 2024

Pokemon Let's Go Fortune Teller guide: how to use the nature lady to influence Pokemon natures27 setembro 2024 -

How to make Plant in Little Alchemy - HowRepublic27 setembro 2024

How to make Plant in Little Alchemy - HowRepublic27 setembro 2024 -

Roupas anos 80: Estilos, fantasias e 140 looks incríveis!27 setembro 2024

Roupas anos 80: Estilos, fantasias e 140 looks incríveis!27 setembro 2024 -

Metacritic Death Stranding Review Bomb Campaign Has Failed - KeenGamer27 setembro 2024

Metacritic Death Stranding Review Bomb Campaign Has Failed - KeenGamer27 setembro 2024 -

Semifinalista volta ao 'The Voice' após dez anos e troca o rock pelo sertanejo - Rádio Itatiaia27 setembro 2024

Semifinalista volta ao 'The Voice' após dez anos e troca o rock pelo sertanejo - Rádio Itatiaia27 setembro 2024