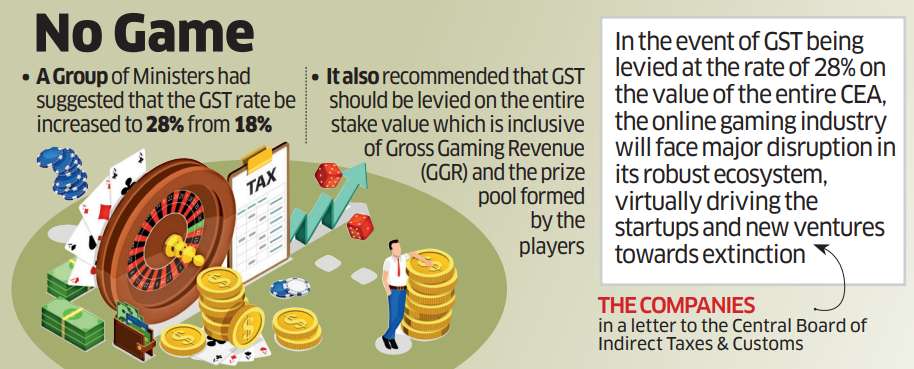

Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 26 setembro 2024

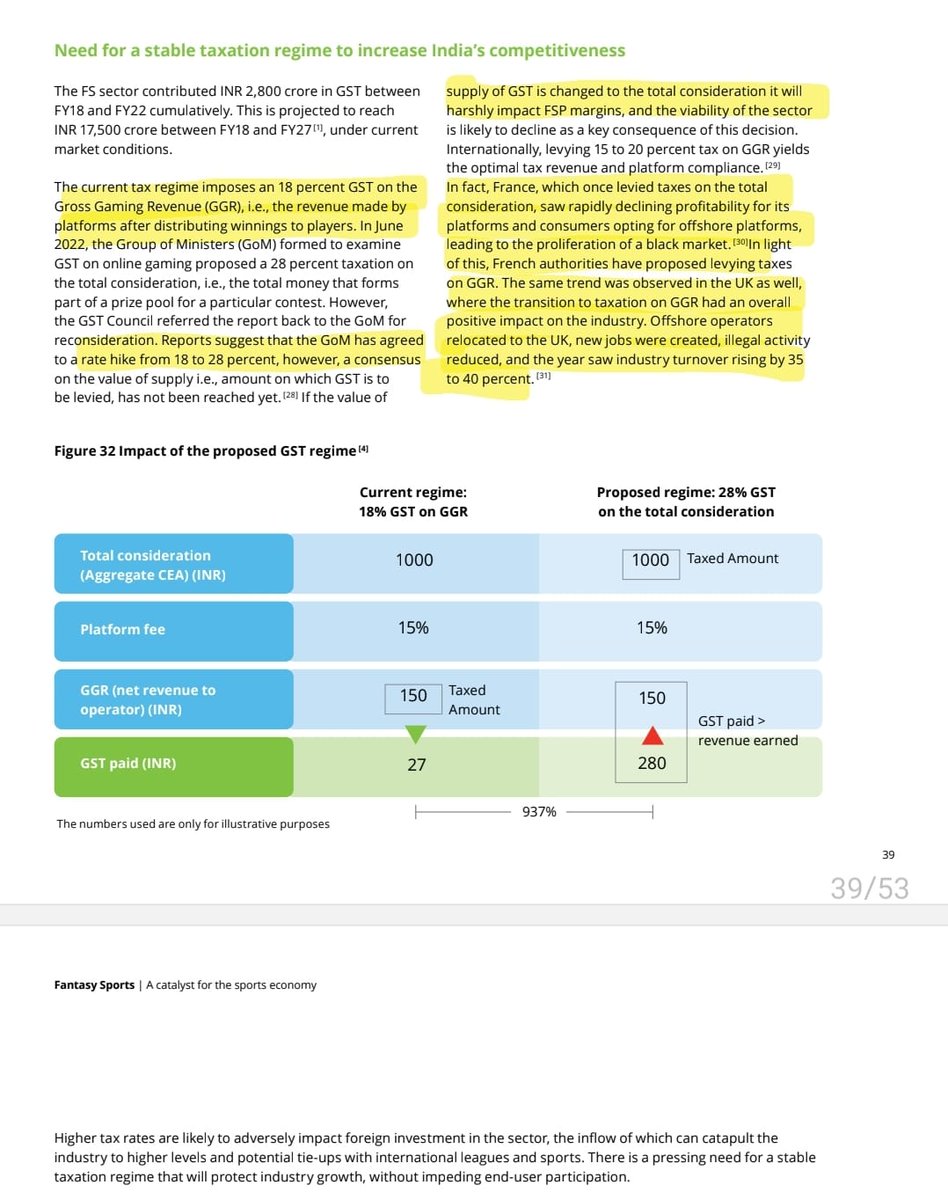

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

28 Percent GST On Online Gaming: Industry Cites Ambiguities Even

Online gaming industry relieved as GST Council clears air on

)

Online gaming industry worried at possible GST hike on skill-based

The Online Gaming Industry Attracts 28% GST On Gross Gaming

No consensus on taxation on online gaming industry - The Sunday

India Levies 28% Tax on Online Gaming - 4 of the Top Platforms

Indian government's decision to impose 28% GST on Online Gaming

The GST council today announced levying 28% taxes on online gaming

Will the implementation of 28% GST rate put the brakes on online

Online Gaming Gst Tax Slab 28 Percent Gom Decision Explained

Indian Online Gaming will accept 28% GST on Gross Revenue, not on

gst: Top gaming firms urge government not to raise GST rate to 28

cbic: Online gaming companies tax demand in line with legal stand

28% GST will prove to be catastrophic for the gaming industry, say

Recomendado para você

-

How To Generate Game Sales From Your Online Store26 setembro 2024

How To Generate Game Sales From Your Online Store26 setembro 2024 -

Gamer Hub. Gamer Hub is a revolutionary online…, by Fikayoh26 setembro 2024

Gamer Hub. Gamer Hub is a revolutionary online…, by Fikayoh26 setembro 2024 -

Gaming Platform Services for IGT - Sigma Software26 setembro 2024

Gaming Platform Services for IGT - Sigma Software26 setembro 2024 -

10 reasons to invest in a gaming tournament platform26 setembro 2024

10 reasons to invest in a gaming tournament platform26 setembro 2024 -

Survey shows Virginia online gamers struggle against insomnia26 setembro 2024

Survey shows Virginia online gamers struggle against insomnia26 setembro 2024 -

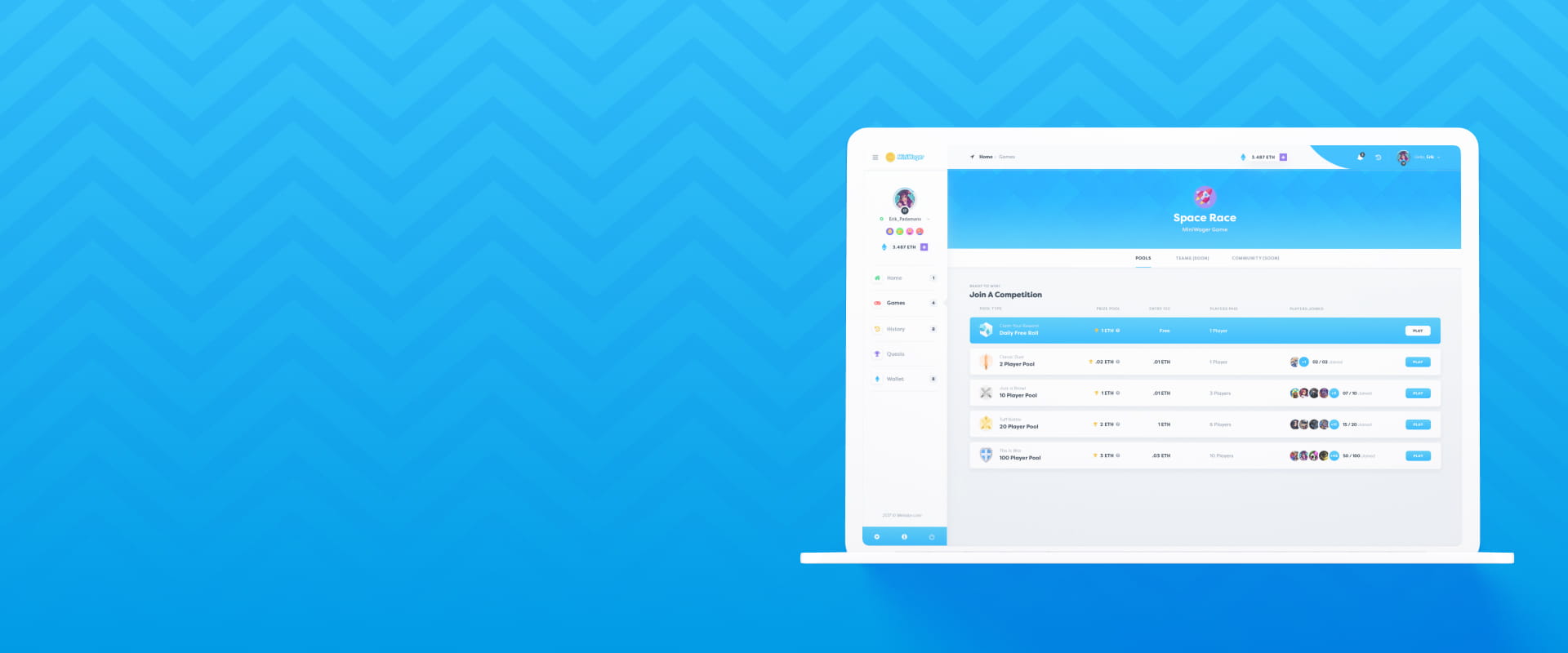

Miniwager - Ethereum-Based Decentralized Online Gaming Platform26 setembro 2024

Miniwager - Ethereum-Based Decentralized Online Gaming Platform26 setembro 2024 -

Evona Games Expands Integration Platform: Unlocking New Value for Your Online Gaming Platform26 setembro 2024

Evona Games Expands Integration Platform: Unlocking New Value for Your Online Gaming Platform26 setembro 2024 -

Online Gaming Platforms - Now Play Digital26 setembro 2024

Online Gaming Platforms - Now Play Digital26 setembro 2024 -

Gaming addiction. Man bearded hipster gamer headphones and keyboard. Play computer games. Online gaming platform. Gaming modern leisure. Cyber sport arena. Gaming PC build guide. Graphics settings Stock Photo by ©stetsik 51056504426 setembro 2024

Gaming addiction. Man bearded hipster gamer headphones and keyboard. Play computer games. Online gaming platform. Gaming modern leisure. Cyber sport arena. Gaming PC build guide. Graphics settings Stock Photo by ©stetsik 51056504426 setembro 2024 -

Cross platform play online gaming concept icon Vector Image26 setembro 2024

Cross platform play online gaming concept icon Vector Image26 setembro 2024

você pode gostar

-

Miles Tails Prower, Mundo Sonic Boom Wiki26 setembro 2024

Miles Tails Prower, Mundo Sonic Boom Wiki26 setembro 2024 -

Afterlife Los Angeles 2023 at Los Angeles State Historic Park, Los Angeles26 setembro 2024

-

Comprar Marvel's Spider-Man - Ps5 Mídia Digital - de R$27,95 a R$47,95 - Ato Games - Os Melhores Jogos com o Melhor Preço26 setembro 2024

Comprar Marvel's Spider-Man - Ps5 Mídia Digital - de R$27,95 a R$47,95 - Ato Games - Os Melhores Jogos com o Melhor Preço26 setembro 2024 -

Earth Chan Minecraft Skins26 setembro 2024

Earth Chan Minecraft Skins26 setembro 2024 -

GRID® Autosport Custom Edition』 APK (無料ダウンロード) - Android ゲーム26 setembro 2024

-

Akashic Records of Bastard Magic Instructor - Episódio 1 (Dublado)26 setembro 2024

Akashic Records of Bastard Magic Instructor - Episódio 1 (Dublado)26 setembro 2024 -

Mass Central Rail Trail - Wikipedia26 setembro 2024

Mass Central Rail Trail - Wikipedia26 setembro 2024 -

Booster Box Evoluções em Paldea Cartas Pokémon Tcg Copag26 setembro 2024

Booster Box Evoluções em Paldea Cartas Pokémon Tcg Copag26 setembro 2024 -

Comprar o The Experiment: Escape Room26 setembro 2024

-

Trevo BR 251 e MGT 122, Entre os Municipios Montes Claros, …26 setembro 2024

Trevo BR 251 e MGT 122, Entre os Municipios Montes Claros, …26 setembro 2024