Ishka: SLB returns: Unlevered IRR and NPV analysis

Por um escritor misterioso

Last updated 20 junho 2024

This data sheet is an illustrative look at net present values (NPVs), and unlevered returns (IRRs) for six hypothetical sale/leaseback (SLB) transactions informed by rumoured pricing terms of real SLB deals concluded between May and July 2023.

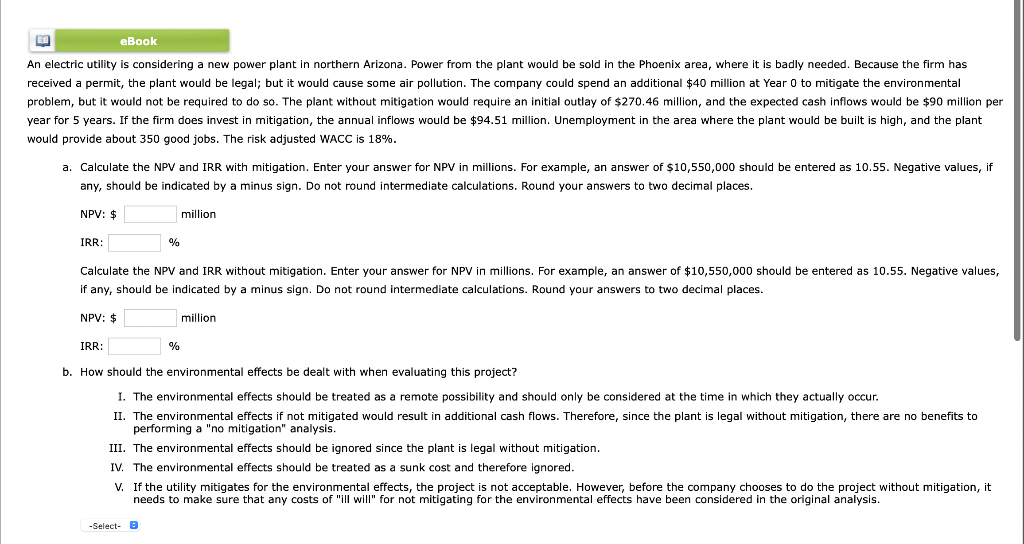

Solved NPV: $ million IRR: % Calculate the NPV and IRR

IRR sensitivity graph 3.6.2. Net Present Value Sensitivity. The result

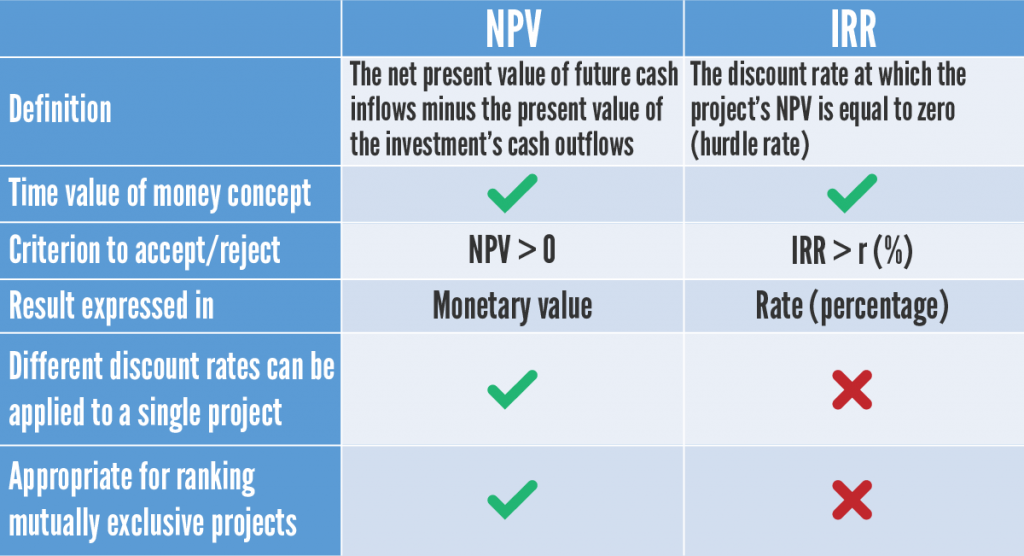

NPV vs. IRR – 365 Financial Analyst

The Internal Rate of Return

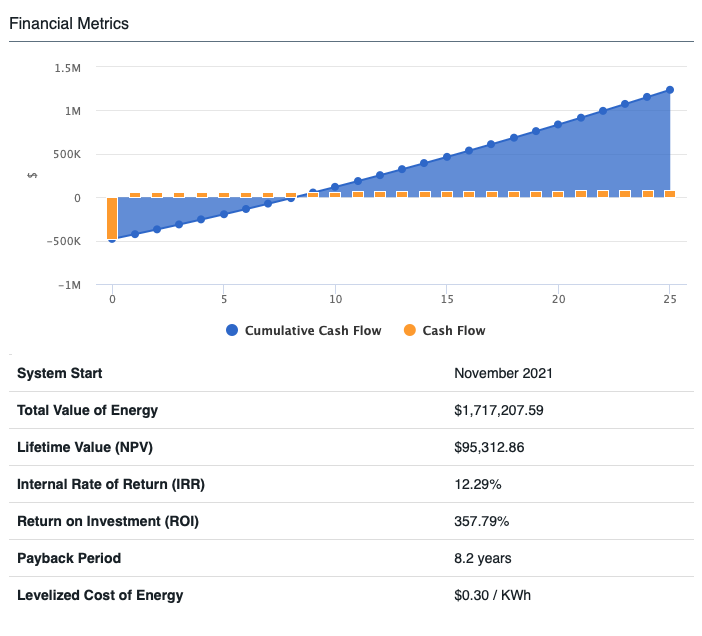

Explaining Financial Metrics like NPV, IRR, and ROI – HelioScope

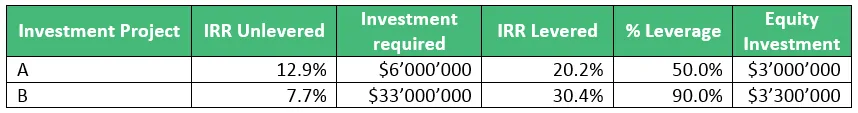

Leveraged vs. Unleveraged IRR: What You Need to Know

Leveraged vs. Unleveraged IRR: What You Need to Know

Net Present Value (NPV) vs. Internal Rate of Return (IRR) – the Basics - The Idea to Market Blog

Ishka: Aviation Finance on LinkedIn: SLB returns: Unlevered IRR and NPV analysis

Ishka: Aviation Finance on LinkedIn: SLB returns: Unlevered IRR and NPV analysis

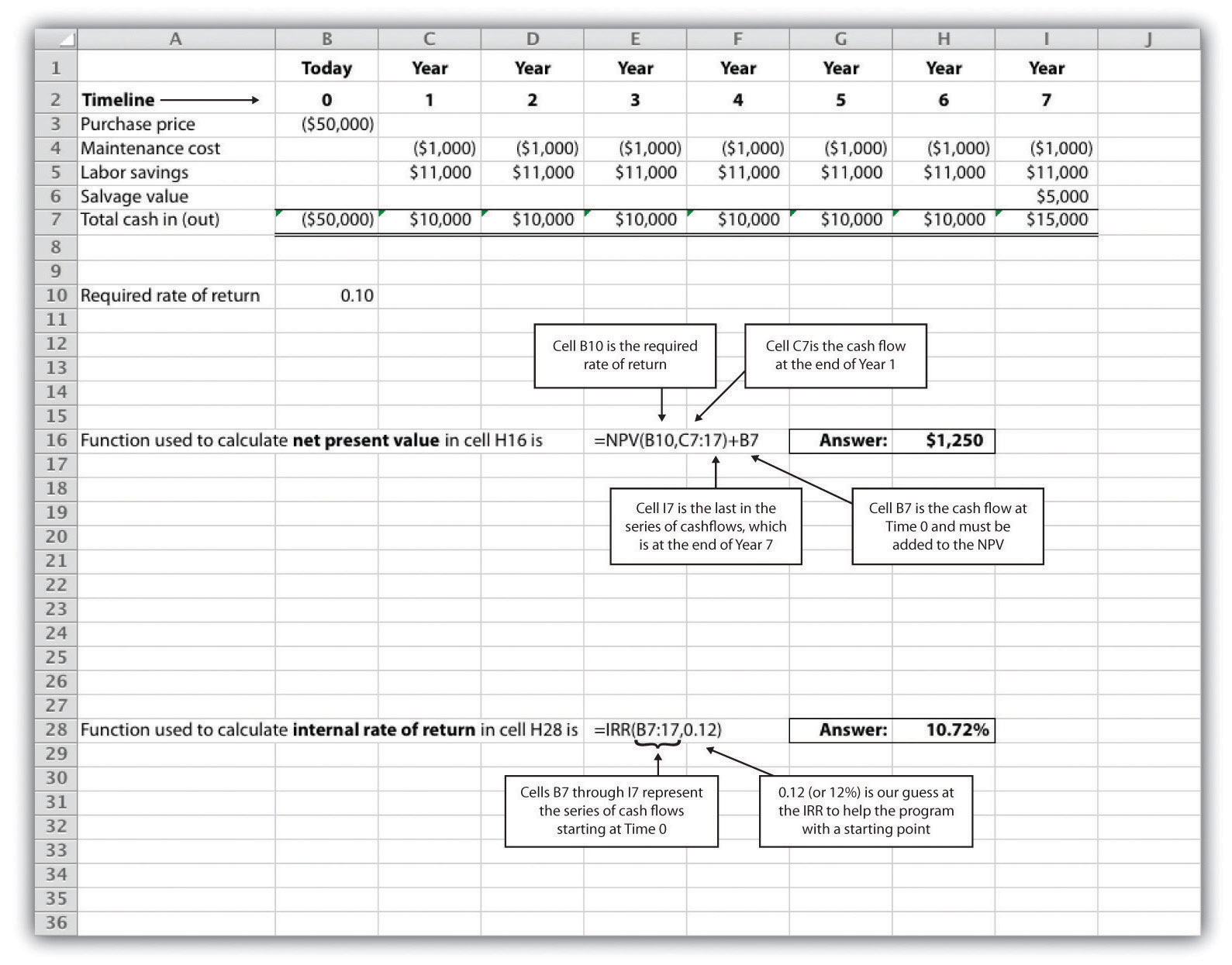

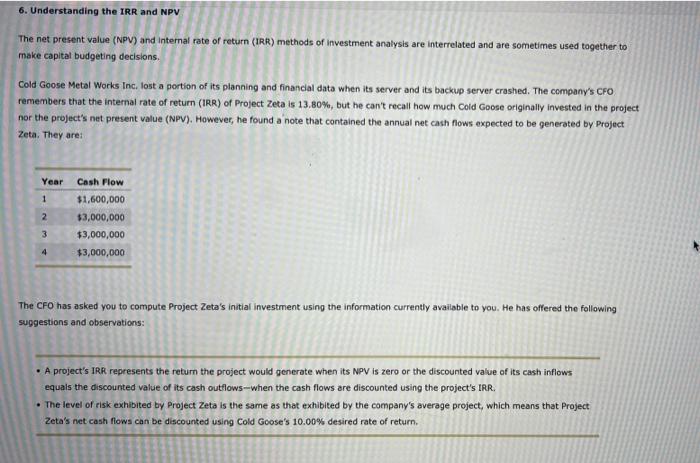

Solved 6. Understanding the IRR and NPV The net present

Understanding Levered vs. Unlevered Cash Flow in Real Estate

Ishka: Aviation Industry Reports – Aviation Finance Market Data

LOS B, Reading 28 - Corporate Issuers, CFA Level 1

Recomendado para você

-

Das Opfer Von Ostrolenka Oder Die Familie Kolesko: Novelle in Drei Theilen, Volume 1 (German Edition): 9781271233496: Doring, Georg: Books20 junho 2024

Das Opfer Von Ostrolenka Oder Die Familie Kolesko: Novelle in Drei Theilen, Volume 1 (German Edition): 9781271233496: Doring, Georg: Books20 junho 2024 -

I Stand With Trump Never Surrender Support For Donald Trump Zip Hoodie : Clothing, Shoes & Jewelry20 junho 2024

I Stand With Trump Never Surrender Support For Donald Trump Zip Hoodie : Clothing, Shoes & Jewelry20 junho 2024 -

IRB LinkedIn20 junho 2024

-

إتحاد سيدي لخضر IRBSL20 junho 2024

-

Catalog - IRB Advisors, Inc.20 junho 2024

Catalog - IRB Advisors, Inc.20 junho 2024 -

IRBManager Tulane Office of Research20 junho 2024

IRBManager Tulane Office of Research20 junho 2024 -

Overview - Mayo Clinic Research20 junho 2024

Overview - Mayo Clinic Research20 junho 2024 -

Yudia (@JoudiaBOUJDAINI) / X20 junho 2024

Yudia (@JoudiaBOUJDAINI) / X20 junho 2024 -

I found an Old Meta Team (Old Image) : r/CookieRunKingdoms20 junho 2024

I found an Old Meta Team (Old Image) : r/CookieRunKingdoms20 junho 2024 -

Amosfun 30 peças de adesivo de espelho de coração com glitter, adesivos de parede reflexivos autoadesivos para parede para quarto de casamento, sala de estar, decoração de hotel20 junho 2024

Amosfun 30 peças de adesivo de espelho de coração com glitter, adesivos de parede reflexivos autoadesivos para parede para quarto de casamento, sala de estar, decoração de hotel20 junho 2024

você pode gostar

-

Ant-Man and the Wasp Quantum Realm Special Effects, Explained - Thrillist20 junho 2024

Ant-Man and the Wasp Quantum Realm Special Effects, Explained - Thrillist20 junho 2024 -

Crunchyroll agora inclui jogos em sua assinatura20 junho 2024

Crunchyroll agora inclui jogos em sua assinatura20 junho 2024 -

Raikou V - 048/172 Ultra Rare - Brilliant Stars20 junho 2024

Raikou V - 048/172 Ultra Rare - Brilliant Stars20 junho 2024 -

77 saborosas frutas em italiano para você se deliciar20 junho 2024

-

Memory and Forgetting - ZNetwork20 junho 2024

Memory and Forgetting - ZNetwork20 junho 2024 -

1St Bubble Tea & Ice Cream20 junho 2024

-

Labirinto do Terror 2022 DVD-R AUTORADO20 junho 2024

Labirinto do Terror 2022 DVD-R AUTORADO20 junho 2024 -

Shopee Brasil Ofertas incríveis. Melhores preços do mercado20 junho 2024

-

Prince of Persia: The Forgotten Sands - PSP20 junho 2024

Prince of Persia: The Forgotten Sands - PSP20 junho 2024 -

What anime should you watch based on your MBTI type? - Quora20 junho 2024