DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Last updated 31 maio 2024

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

How to File DoorDash Taxes DoorDash Drivers Write-offs

DoorDash Software Engineer Salary: Compensation, Benefits, and More

How to File DoorDash Taxes DoorDash Drivers Write-offs

Gig workers need to get ready for tax forms - Protocol

DoorDash 1099 Taxes: Your Guide to Forms, Write-Offs, and More

How to File DoorDash Taxes DoorDash Drivers Write-offs

9 Best Apps To Track Mileage For DoorDash (2023)

Earn by time is better than most people Ass-U-me, and better for

Travel expense tax deduction guide: How to maximize write-offs

Track mileage with Everlance

Places With the Highest and Lowest Income Tax Rate and Take Home

Deliver with DoorDash? Save $20 on Your Taxes with TurboTax Self

DoorDash or Uber Taxes 1099 NEC What you need to know!

7 Reasons Why All Gig Workers Need a Mileage Tracking App

Recomendado para você

-

Dasher Signup Process31 maio 2024

-

Doordash driver app not working - How to fix31 maio 2024

Doordash driver app not working - How to fix31 maio 2024 -

A Starter Guide to DoorDash and How the Delivery App Works31 maio 2024

-

Getting started with DoorDash Developer31 maio 2024

Getting started with DoorDash Developer31 maio 2024 -

What Should I Do After a DoorDash Driver Car Accident?31 maio 2024

What Should I Do After a DoorDash Driver Car Accident?31 maio 2024 -

DoorDash Delivery Driver: What I Wish I Knew Before Taking the Job31 maio 2024

-

DoorDash on X: Delivery drivers needed now! Our drivers choose31 maio 2024

DoorDash on X: Delivery drivers needed now! Our drivers choose31 maio 2024 -

DoorDash Driver Switches to hHourly Pay. He Receives $0 in Tips31 maio 2024

DoorDash Driver Switches to hHourly Pay. He Receives $0 in Tips31 maio 2024 -

70% of Washington DoorDash drivers would quit if flexibility31 maio 2024

70% of Washington DoorDash drivers would quit if flexibility31 maio 2024 -

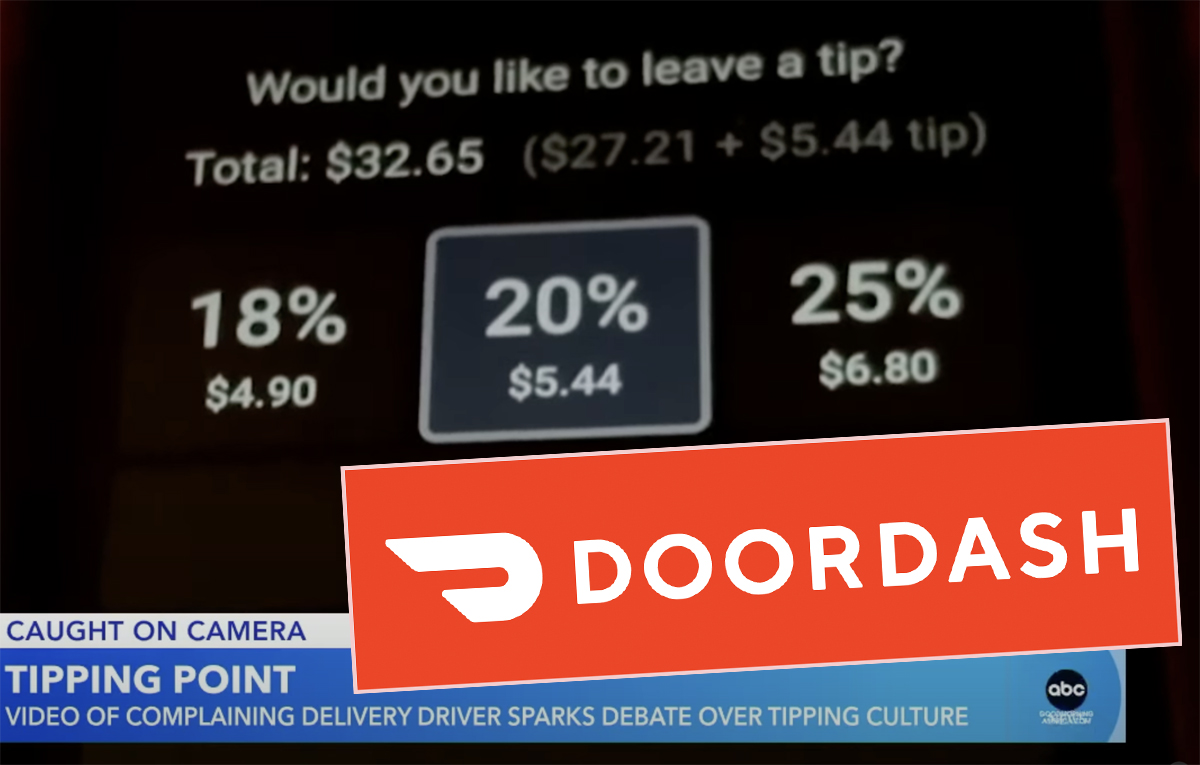

DoorDash Driver FIRED After Cursing Out Customer Over 25% Tip31 maio 2024

DoorDash Driver FIRED After Cursing Out Customer Over 25% Tip31 maio 2024

você pode gostar

-

Modern Warfare 2 weapons, skins and operators will carry over to31 maio 2024

Modern Warfare 2 weapons, skins and operators will carry over to31 maio 2024 -

Roblox Studio31 maio 2024

Roblox Studio31 maio 2024 -

![Rurouni Kenshin: The Legend Ends [2014] - Best Buy](https://pisces.bbystatic.com/image2/BestBuy_US/images/products/cfdf11f7-c348-409b-918d-92aa435caceb.jpg;maxHeight=640;maxWidth=550) Rurouni Kenshin: The Legend Ends [2014] - Best Buy31 maio 2024

Rurouni Kenshin: The Legend Ends [2014] - Best Buy31 maio 2024 -

HelloItsVG on X: Roblox just turned everybody into NOOB avatar31 maio 2024

HelloItsVG on X: Roblox just turned everybody into NOOB avatar31 maio 2024 -

:format(webp):quality(80)/https%3A%2F%2Fwww.prosport.ro%2Fwp-content%2Fuploads%2F2021%2F02%2Flouis-munteanu-fiorentina-oferte-refuzate-debut-2.jpg) Louis Munteanu, dublă în poarta lui AC Milan U19! Atacantul român, contra lui Dennis Man și Valentin Mihăilă! A fost convocat la prima echipă pentru Fiorentina - Parma31 maio 2024

Louis Munteanu, dublă în poarta lui AC Milan U19! Atacantul român, contra lui Dennis Man și Valentin Mihăilă! A fost convocat la prima echipă pentru Fiorentina - Parma31 maio 2024 -

:max_bytes(150000):strip_icc():focal(691x225:693x227)/Jennifer-Lawrence-hunger-games-061023-946e618e010c4d68938c89a5fd7c6834.jpg) Jennifer Lawrence Is 'Totally' Open to Playing 'Hunger Games' Role Again31 maio 2024

Jennifer Lawrence Is 'Totally' Open to Playing 'Hunger Games' Role Again31 maio 2024 -

Monaliza Krepe, 🤎 Direito Bancário na Prática on Instagram: Aproveita e clica no link da Bio de @monalizakrepe #oab1fase #oabmg #oabp… em 202331 maio 2024

Monaliza Krepe, 🤎 Direito Bancário na Prática on Instagram: Aproveita e clica no link da Bio de @monalizakrepe #oab1fase #oabmg #oabp… em 202331 maio 2024 -

FIFA 18 - PlayStation 431 maio 2024

FIFA 18 - PlayStation 431 maio 2024 -

Tired of One Piece and Bleach? 2023 Still Has Some Epic Anime Yet to be Released - Isekai, Vampire Action, and More - FandomWire31 maio 2024

Tired of One Piece and Bleach? 2023 Still Has Some Epic Anime Yet to be Released - Isekai, Vampire Action, and More - FandomWire31 maio 2024 -

Como fazer batata frita na airfryer: receita fácil e saudável31 maio 2024

Como fazer batata frita na airfryer: receita fácil e saudável31 maio 2024