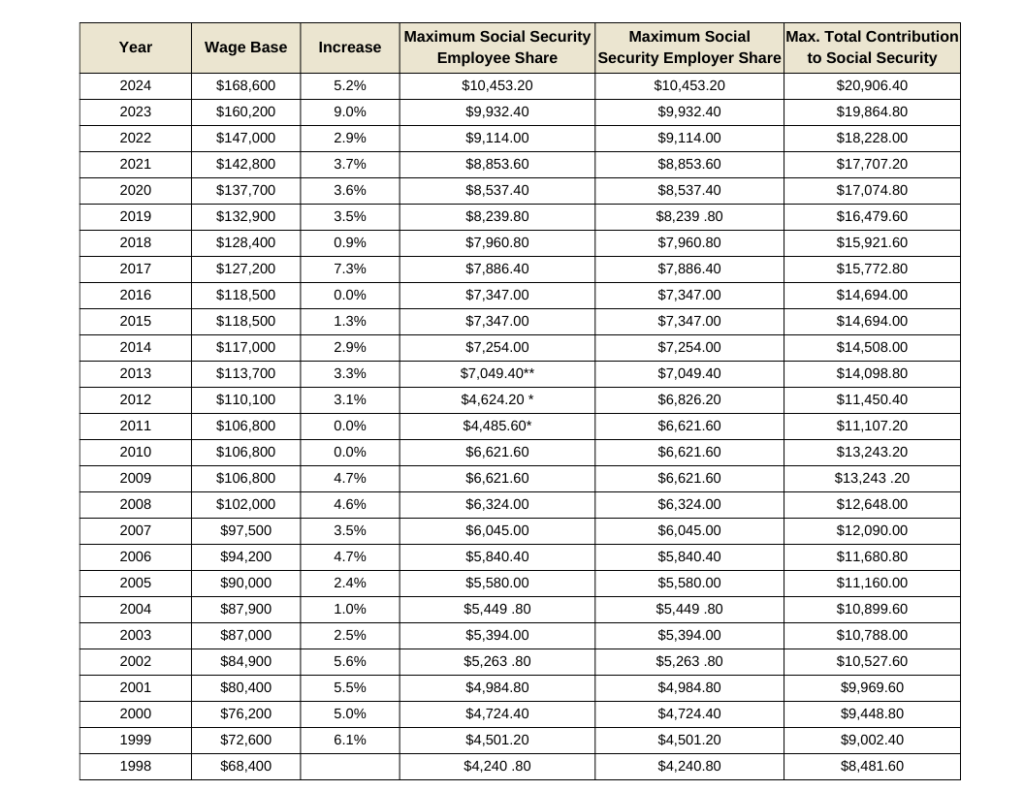

Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 02 junho 2024

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

Wage Base Limit - FasterCapital

Form W-2 Explained

How the Wage Base Limit Affects Your Social Security

:max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png)

What Is Payroll, With Step-by-Step Calculation of Payroll Taxes

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

Social Security Wage Base 2021 [Updated for 2024] - UZIO Inc

Just Announced: Increase to Social Security Wage Base For 2021

Wage Base Limit - FasterCapital

Understanding Your W-2

Recomendado para você

-

What Is FICA Tax: How It Works And Why You Pay02 junho 2024

What Is FICA Tax: How It Works And Why You Pay02 junho 2024 -

What Is the FICA Tax and Why Does It Exist? - TheStreet02 junho 2024

What Is the FICA Tax and Why Does It Exist? - TheStreet02 junho 2024 -

Social Security Administration - “What is FICA on my paycheck?” Find out02 junho 2024

-

Employee Social Security Tax Deferral Repayment02 junho 2024

Employee Social Security Tax Deferral Repayment02 junho 2024 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software02 junho 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software02 junho 2024 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence02 junho 2024

The FICA Tax: How Social Security Is Funded – Social Security Intelligence02 junho 2024 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social02 junho 2024

-

What is the FICA Tax Refund? - Boundless02 junho 2024

What is the FICA Tax Refund? - Boundless02 junho 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and02 junho 2024

-

What it means: COVID-19 Deferral of Employee FICA Tax02 junho 2024

What it means: COVID-19 Deferral of Employee FICA Tax02 junho 2024

você pode gostar

-

Legend Of Zelda Creator Shigeru Miyamoto Wanted To Cut Navi02 junho 2024

Legend Of Zelda Creator Shigeru Miyamoto Wanted To Cut Navi02 junho 2024 -

![4] Shiny Giratina appears after 4250 SRs in Platinum. Devil snake](https://i.redd.it/4p4rul4n2ruy.jpg) 4] Shiny Giratina appears after 4250 SRs in Platinum. Devil snake02 junho 2024

4] Shiny Giratina appears after 4250 SRs in Platinum. Devil snake02 junho 2024 -

Light Novel Volume 26, Death March to the Parallel World Rhapsody Wiki02 junho 2024

Light Novel Volume 26, Death March to the Parallel World Rhapsody Wiki02 junho 2024 -

Undecember - how to craft skill runes YOU CANT BUY02 junho 2024

Undecember - how to craft skill runes YOU CANT BUY02 junho 2024 -

O Cálculo extraordinário de Reuben Fine! - Análise Rafael Leitão02 junho 2024

O Cálculo extraordinário de Reuben Fine! - Análise Rafael Leitão02 junho 2024 -

Baseball Championship Logo Design Graphic by nipnoob · Creative Fabrica02 junho 2024

Baseball Championship Logo Design Graphic by nipnoob · Creative Fabrica02 junho 2024 -

Judy Hicks, Scream Wiki02 junho 2024

Judy Hicks, Scream Wiki02 junho 2024 -

Flake-Free Hair Care with Head & Shoulders02 junho 2024

Flake-Free Hair Care with Head & Shoulders02 junho 2024 -

Supercell02 junho 2024

Supercell02 junho 2024 -

Mavin Pokemon TCG Mewtwo 56/172 Holo Rare Card Halloween Trick Or Trade MINT02 junho 2024

Mavin Pokemon TCG Mewtwo 56/172 Holo Rare Card Halloween Trick Or Trade MINT02 junho 2024