Tackling the tax code: Efficient and equitable ways to raise revenue

Por um escritor misterioso

Last updated 05 junho 2024

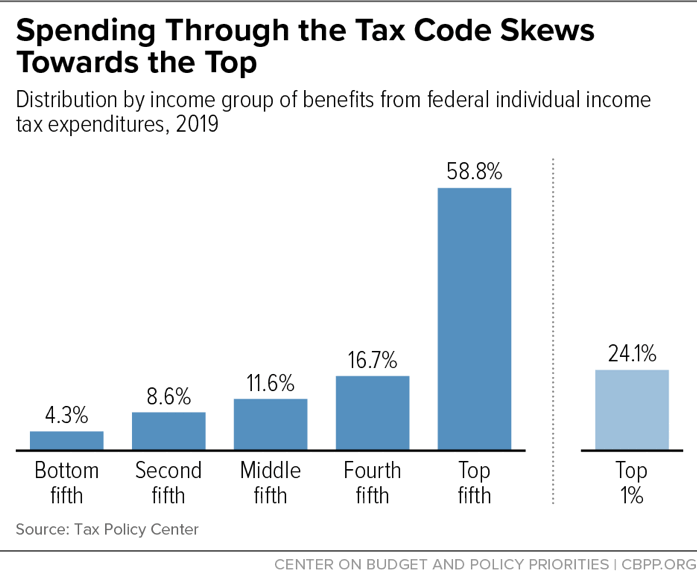

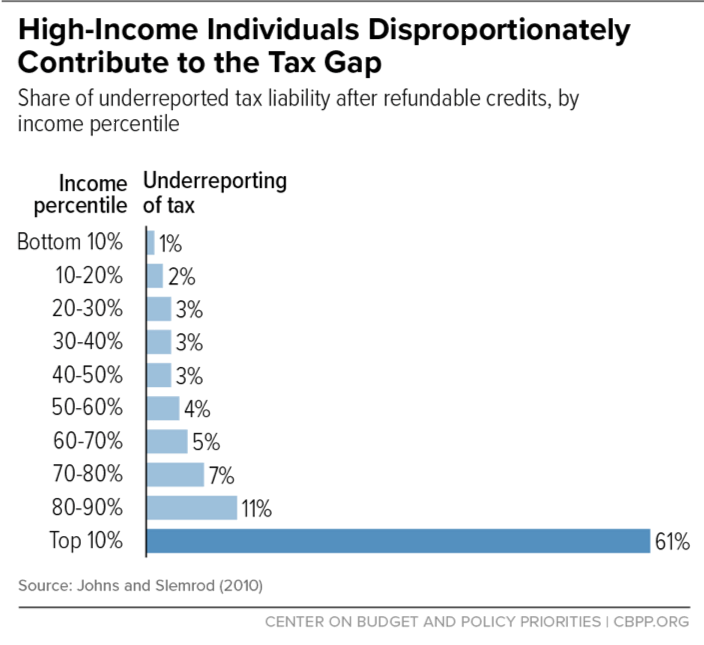

This book presents new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, reforming the corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws are better enforced and administered.

Tackling the tax code: Efficient and equitable ways to raise

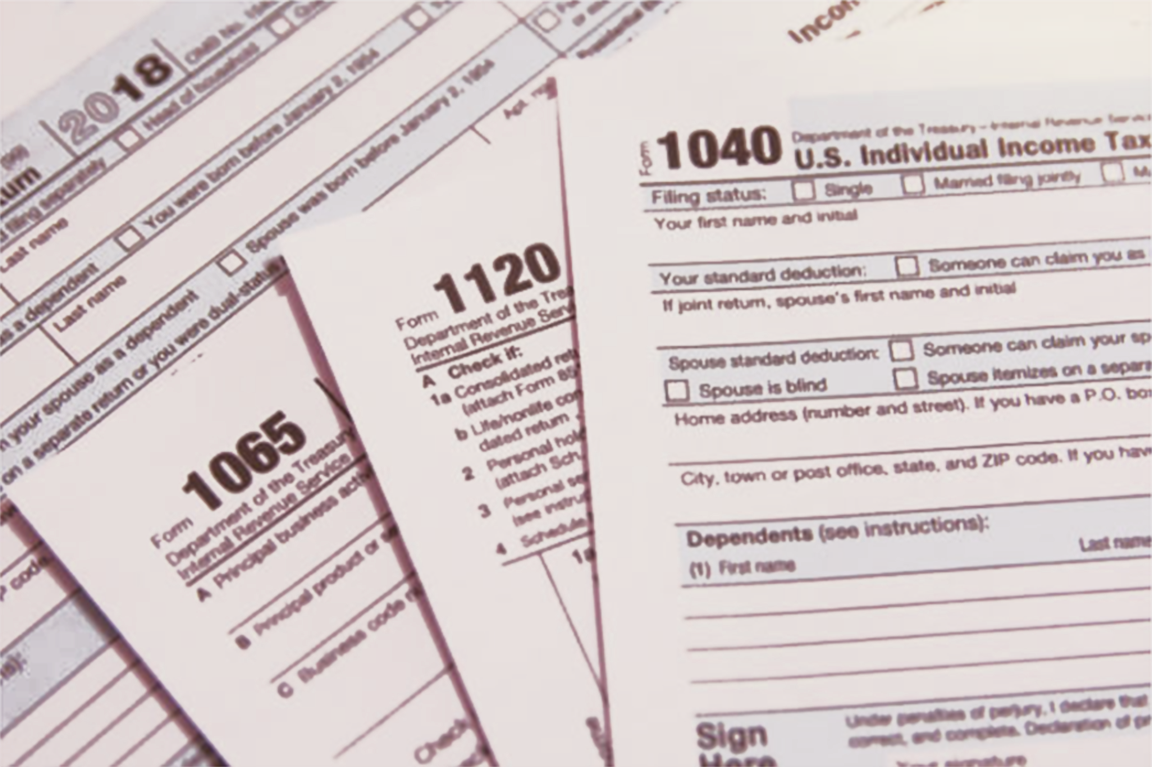

How the Federal Tax Code Can Better Advance Racial Equity

:max_bytes(150000):strip_icc()/tax_avoidance.asp-Final-9d7e3d82dc5c4ce293256ff9d548494d.png)

What Is Tax Avoidance and How Is It Different From Tax Evasion?

10 Tax Reforms for Economic Growth and Opportunity

PDF) Tax Reduction Strategies for the Entry of Taxpayers to Reduce

Tax revenue: A Key Ingredient in Maintaining a Balanced Budget

How the Federal Tax Code Can Better Advance Racial Equity

Towards a new tax system in Ukraine

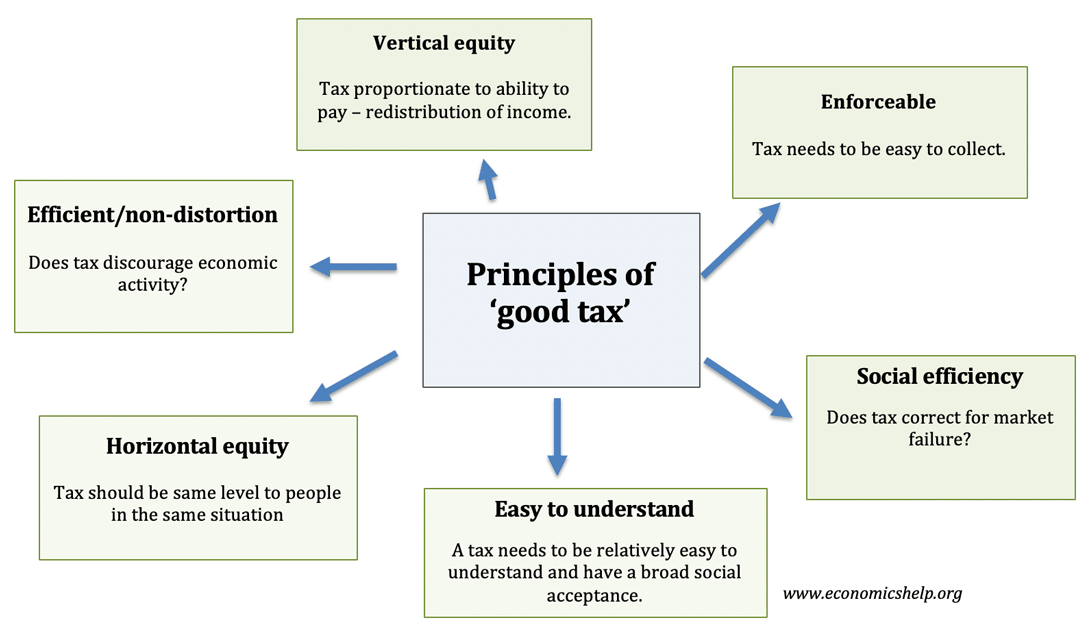

The qualities of a good tax - Economics Help

Tackling the tax code: Efficient and equitable ways to raise

Recomendado para você

-

THE MARGINAL SERVICE Official Teaser Trailer - BiliBili05 junho 2024

THE MARGINAL SERVICE Official Teaser Trailer - BiliBili05 junho 2024 -

Watch El marginal Netflix Official Site05 junho 2024

Watch El marginal Netflix Official Site05 junho 2024 -

PPT - The Economic Way of Thinking PowerPoint Presentation, free download - ID:599113605 junho 2024

PPT - The Economic Way of Thinking PowerPoint Presentation, free download - ID:599113605 junho 2024 -

Chapter 1105 junho 2024

Chapter 1105 junho 2024 -

Chapter 1 - Summary Essentials of Economics - Chapter 1 Economics is used to answer questions such - Studocu05 junho 2024

Chapter 1 - Summary Essentials of Economics - Chapter 1 Economics is used to answer questions such - Studocu05 junho 2024 -

Marginal Manga Online Free - Manganelo05 junho 2024

Marginal Manga Online Free - Manganelo05 junho 2024 -

ECO 202 MODULE 3.docx - ECO 202 MODULE 3 ECO 202 MODULE 3 ECO 202 MODULE 3 ECO 202 MODULE 3 ECO 202 MODULE 305 junho 2024

ECO 202 MODULE 3.docx - ECO 202 MODULE 3 ECO 202 MODULE 3 ECO 202 MODULE 3 ECO 202 MODULE 3 ECO 202 MODULE 305 junho 2024 -

Read Marginal Vol.1 Chapter 1 on Mangakakalot05 junho 2024

Read Marginal Vol.1 Chapter 1 on Mangakakalot05 junho 2024 -

:max_bytes(150000):strip_icc()/five-determinants-of-demand-with-examples-and-formula-3305706-2022-02a2302a2f974d6c9c953f4a3be50889.png) 5 Determinants of Demand With Examples and Formula05 junho 2024

5 Determinants of Demand With Examples and Formula05 junho 2024 -

PDF) Services Marketing: People, Technology, Strategy; 9th edition05 junho 2024

PDF) Services Marketing: People, Technology, Strategy; 9th edition05 junho 2024

você pode gostar

-

80% Shadowrun Trilogy on05 junho 2024

80% Shadowrun Trilogy on05 junho 2024 -

Nepomniachtchi: What Went Wrong?05 junho 2024

Nepomniachtchi: What Went Wrong?05 junho 2024 -

César Menotti & Fabiano - É Tarde Demais / Do Lado Esquerdo / Bão Tamém (Clipe Oficial)05 junho 2024

César Menotti & Fabiano - É Tarde Demais / Do Lado Esquerdo / Bão Tamém (Clipe Oficial)05 junho 2024 -

The Legend of Zelda: A Link to the Past, Wiki Zelda05 junho 2024

The Legend of Zelda: A Link to the Past, Wiki Zelda05 junho 2024 -

Demonfall 2.8.5 Update Patch Notes - Try Hard Guides05 junho 2024

Demonfall 2.8.5 Update Patch Notes - Try Hard Guides05 junho 2024 -

Personalized Winking Face Emoji Bib – Designs by Chad & Jake05 junho 2024

Personalized Winking Face Emoji Bib – Designs by Chad & Jake05 junho 2024 -

Toyota Corolla 2019 em Araucária05 junho 2024

-

XBOX SERIES X/S HOW TO DOWNLOAD FREE GAMES!05 junho 2024

XBOX SERIES X/S HOW TO DOWNLOAD FREE GAMES!05 junho 2024 -

Sergei Titov on X: Soviet Batman and Joker from @mrmarkmillar 's Red Son. The Joker design is based on Dr. David Livesey from the 1988 animated adaptation of Treasure Island by Kievnauchfilm05 junho 2024

-

TF2 - WAR! ( Full song ) Roblox ID - Roblox music codes05 junho 2024

TF2 - WAR! ( Full song ) Roblox ID - Roblox music codes05 junho 2024