Refund of Unutilized ITC on Zero Rated Outward Supply of Exempted Goods

Por um escritor misterioso

Last updated 20 outubro 2024

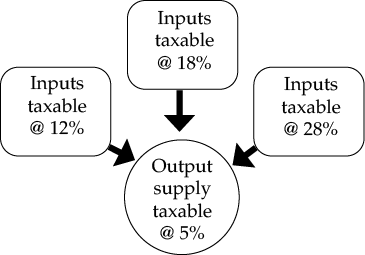

Refund of Unutilized Input Tax Credit (ITC) on Zero Rated Outward Supply of Exempted Goods As per Section 17(2) of CGST Act, 2017– ’Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the IGST, and partly for effecting […]

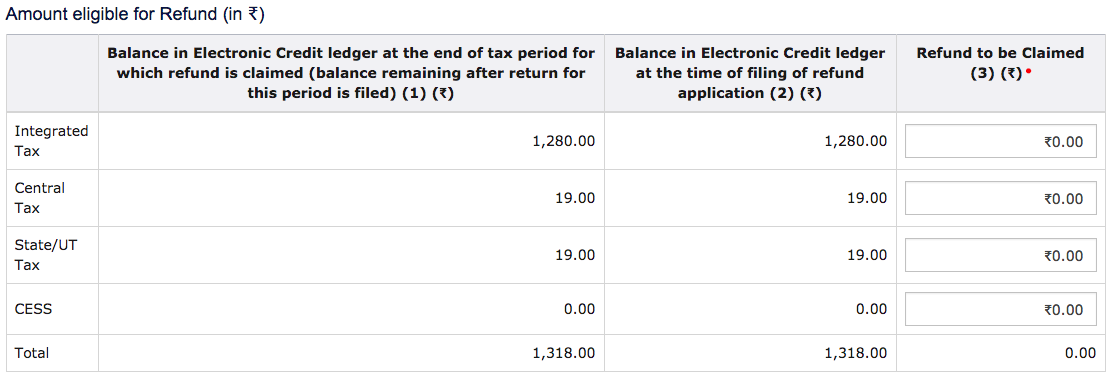

Refund of Unutilised Input Tax Credit for Zero-Rated Supplies

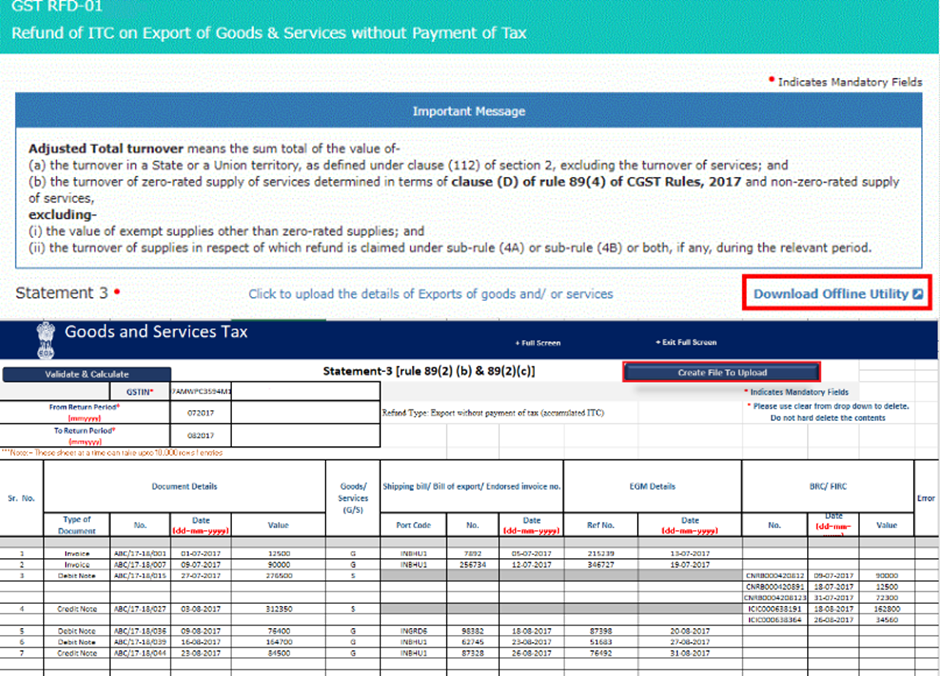

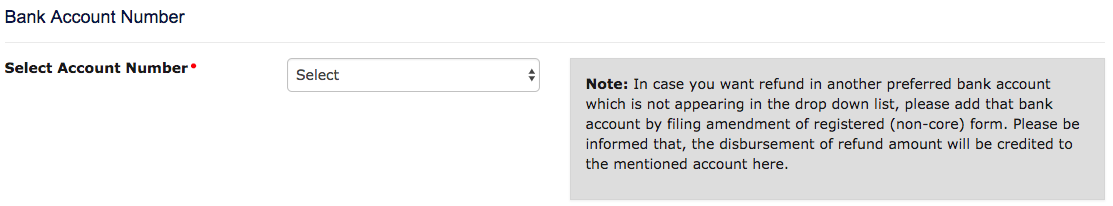

All about GST Refunds, A Reference Manual, Version 2.0

Refund, PDF, Taxes

GST: Seeks to clarify the fully electronic refund process through

HOW TO FILE GST RETURN FOR SHOPIFY DROPSHIPPING IN INDIA

Zero rated supplies under GST

GST Refund Services, Procedure, Benefits

Refund under Inverted Duty Structure « AIFTP

Refund of Unutilised Input Tax Credit for Zero-Rated Supplies

Refund of Unutilised ITC in GST -StartupFino

Recomendado para você

-

Release of options for the FR-A842 Serving as a High Power Factor Converter, New Product RELEASE, Inverters-FREQROL20 outubro 2024

Release of options for the FR-A842 Serving as a High Power Factor Converter, New Product RELEASE, Inverters-FREQROL20 outubro 2024 -

Sanjoe IGBT Plasma Cutting Machine CUT100 15.2KVA Rated Input Power20 outubro 2024

Sanjoe IGBT Plasma Cutting Machine CUT100 15.2KVA Rated Input Power20 outubro 2024 -

Omron G3NA-225B DC5-24 Solid State Relay, Zero Cross Function, Yellow Indicator, Phototriac Coupler Isolation, 25 A Rated Load Current, 24 to 240 VAC Rated Load Voltage, 5 to 24 VDC Input Voltage20 outubro 2024

Omron G3NA-225B DC5-24 Solid State Relay, Zero Cross Function, Yellow Indicator, Phototriac Coupler Isolation, 25 A Rated Load Current, 24 to 240 VAC Rated Load Voltage, 5 to 24 VDC Input Voltage20 outubro 2024 -

Energizer Power Packs - Products20 outubro 2024

Energizer Power Packs - Products20 outubro 2024 -

What changed when Ugandan farmers rated input quality and local vendor services20 outubro 2024

What changed when Ugandan farmers rated input quality and local vendor services20 outubro 2024 -

Pfxgp4116t2d Hmi,Rated Input Voltage12to24 Vdc,Input Voltage Limits10.2to28.8 Vdc20 outubro 2024

Pfxgp4116t2d Hmi,Rated Input Voltage12to24 Vdc,Input Voltage Limits10.2to28.8 Vdc20 outubro 2024 -

ABB 1SVR427032R0000 :: 2.5A, 1P, 100-240V, 24VDC, CP-E Power Supply :: PLATT ELECTRIC SUPPLY20 outubro 2024

ABB 1SVR427032R0000 :: 2.5A, 1P, 100-240V, 24VDC, CP-E Power Supply :: PLATT ELECTRIC SUPPLY20 outubro 2024 -

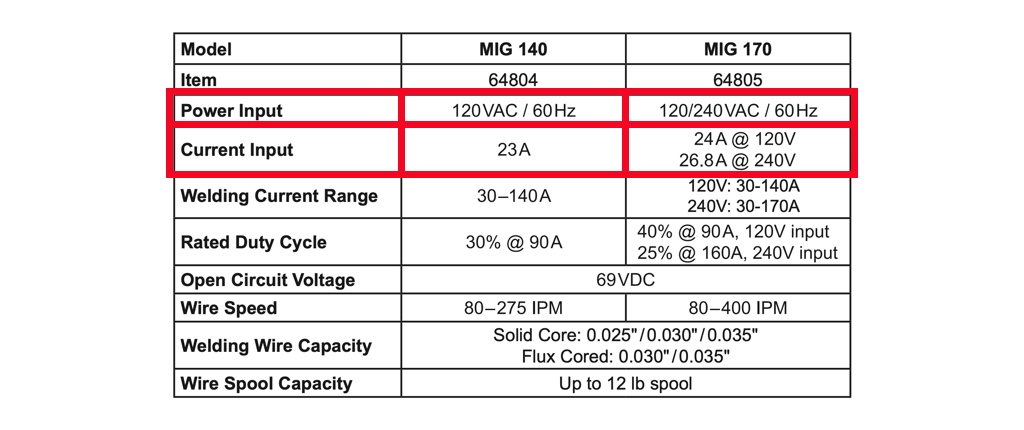

What Size Generator For Welding? (How to Calculate It)20 outubro 2024

What Size Generator For Welding? (How to Calculate It)20 outubro 2024 -

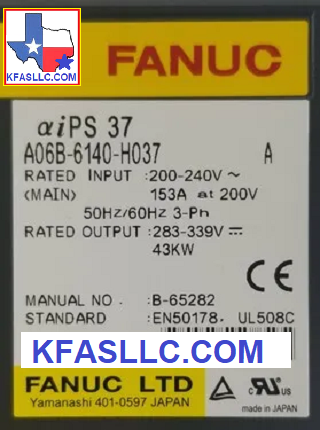

A06B-6140-H037 A06B6140H037 Fanuc/ GE Fanuc Alpha-i Power Supply Module20 outubro 2024

A06B-6140-H037 A06B6140H037 Fanuc/ GE Fanuc Alpha-i Power Supply Module20 outubro 2024 -

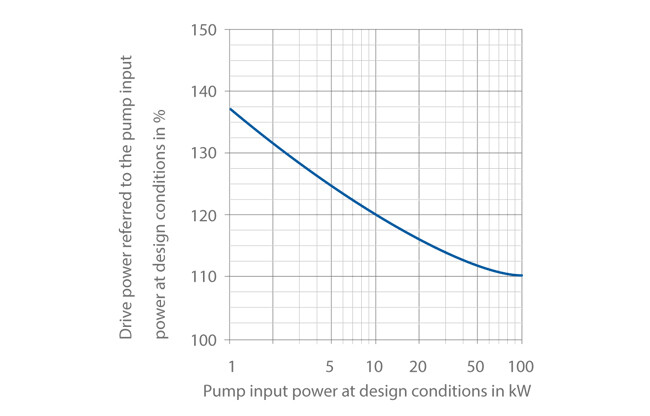

Drive rating20 outubro 2024

Drive rating20 outubro 2024

você pode gostar

-

Figura de batalla de Pokemon, Paquete de tema de tipo agua 3 Pokemon Pokemon20 outubro 2024

Figura de batalla de Pokemon, Paquete de tema de tipo agua 3 Pokemon Pokemon20 outubro 2024 -

Animes Online Project One Piece 482 Dragon Ball Kai 88 Bakuman1320 outubro 2024

Animes Online Project One Piece 482 Dragon Ball Kai 88 Bakuman1320 outubro 2024 -

Hai barbie…. . . . . . #bentocake #bentocakepurwakarta #minicakepurwakarta #koreanbentocake #koreanbentocakepurwakarta #birthdaycake…20 outubro 2024

-

capivara gritando o nome cintia|Pesquisa do TikTok20 outubro 2024

capivara gritando o nome cintia|Pesquisa do TikTok20 outubro 2024 -

![SPOILER] I can't believe I managed to get an Edge ascension on my third playthrough of Exile. The last city was intense, to say the least. How are people feeling about the](https://preview.redd.it/6cbgflikzy251.png?auto=webp&s=1cbae8def139abf5616647178b2552c6e3427b88) SPOILER] I can't believe I managed to get an Edge ascension on my third playthrough of Exile. The last city was intense, to say the least. How are people feeling about the20 outubro 2024

SPOILER] I can't believe I managed to get an Edge ascension on my third playthrough of Exile. The last city was intense, to say the least. How are people feeling about the20 outubro 2024 -

Garlic Butter Shrimp - Damn Delicious20 outubro 2024

Garlic Butter Shrimp - Damn Delicious20 outubro 2024 -

Gacha nox20 outubro 2024

-

ONE PIECE QUEEN DANCE SHOW 😂😂, By Anime Be like20 outubro 2024

-

Sector Space- The Space Shooter MMO Browser Game Windows - Mod DB20 outubro 2024

Sector Space- The Space Shooter MMO Browser Game Windows - Mod DB20 outubro 2024 -

End of TFT set 5.5. Do you know what the top TFT tier comps are?20 outubro 2024

End of TFT set 5.5. Do you know what the top TFT tier comps are?20 outubro 2024