Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Last updated 26 setembro 2024

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

What Are FICA Taxes And Why Do They Matter? - Quikaid

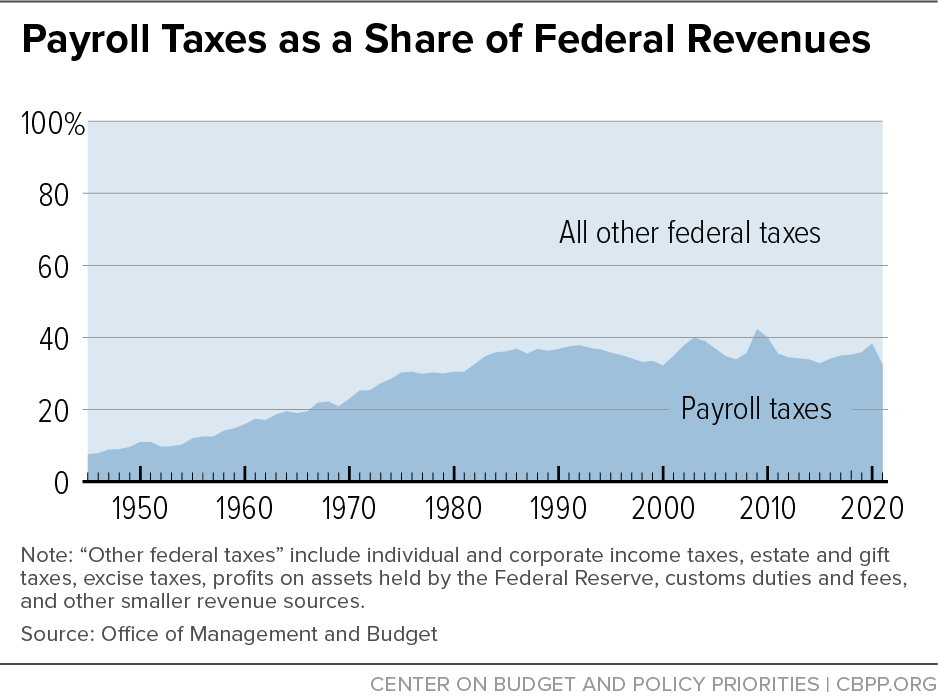

Policy Basics: Federal Payroll Taxes

Federal Insurance Contributions Act (FICA): Definition

Definitions and Importance of Determining Non-FICA Wages — Video

Solved] 1- An employee earned $43,600 during the year working for

Social Security Tax: How To Opt Out

Federal Insurance Contributions Act: FICA - FasterCapital

Federal Insurance Contributions Act (FICA): Definition

The ABCs of FICA: Federal Insurance Contributions Act Explained

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes26 setembro 2024

Learn About FICA, Social Security, and Medicare Taxes26 setembro 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks26 setembro 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks26 setembro 2024 -

Social Security Administration - “What is FICA on my paycheck?” Find out26 setembro 2024

-

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?26 setembro 2024

Why Is There a Cap on the FICA Tax?26 setembro 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations26 setembro 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations26 setembro 2024 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto26 setembro 2024

What Are FICA Taxes And Do They Affect Me?, by M. De Oto26 setembro 2024 -

What is the FICA Tax Refund? - Boundless26 setembro 2024

What is the FICA Tax Refund? - Boundless26 setembro 2024 -

What Is FICA Tax? —26 setembro 2024

What Is FICA Tax? —26 setembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com26 setembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com26 setembro 2024 -

2017 FICA Tax: What You Need to Know26 setembro 2024

2017 FICA Tax: What You Need to Know26 setembro 2024

você pode gostar

-

Boxing Beta Codes (June 2023) - Touch, Tap, Play26 setembro 2024

Boxing Beta Codes (June 2023) - Touch, Tap, Play26 setembro 2024 -

:strip_icc()/i.s3.glbimg.com/v1/AUTH_08fbf48bc0524877943fe86e43087e7a/internal_photos/bs/2020/N/6/lwltvjRwuNAXZmlzX8Ag/xiaomi-mitu-kids-watch-4x-1.jpg) Xiaomi lança smartwatch infantil com bateria para até 7 dias26 setembro 2024

Xiaomi lança smartwatch infantil com bateria para até 7 dias26 setembro 2024 -

GTA: San Andreas: as recompensas oferecidas pelas namoradas - 2526 setembro 2024

GTA: San Andreas: as recompensas oferecidas pelas namoradas - 2526 setembro 2024 -

AGOSTO²: LISTA de JOGOS xCLOUD e GAME PASS da 2ª QUINZENA e 16 JOGOS com CONTROLES TOUTH26 setembro 2024

AGOSTO²: LISTA de JOGOS xCLOUD e GAME PASS da 2ª QUINZENA e 16 JOGOS com CONTROLES TOUTH26 setembro 2024 -

Review Evil West - XboxEra26 setembro 2024

Review Evil West - XboxEra26 setembro 2024 -

What is live web chat? Your in-depth explainer26 setembro 2024

What is live web chat? Your in-depth explainer26 setembro 2024 -

ONE PIECE TCG Playmat: Kin'emon Leader Playmat26 setembro 2024

ONE PIECE TCG Playmat: Kin'emon Leader Playmat26 setembro 2024 -

Uruguay and Brazil secure World Cup berth – Beach Soccer Worldwide26 setembro 2024

Uruguay and Brazil secure World Cup berth – Beach Soccer Worldwide26 setembro 2024 -

この男は人生最大の過ちです 3 (スフレコミックス26 setembro 2024

この男は人生最大の過ちです 3 (スフレコミックス26 setembro 2024 -

King of the Hill26 setembro 2024

King of the Hill26 setembro 2024