FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Last updated 03 junho 2024

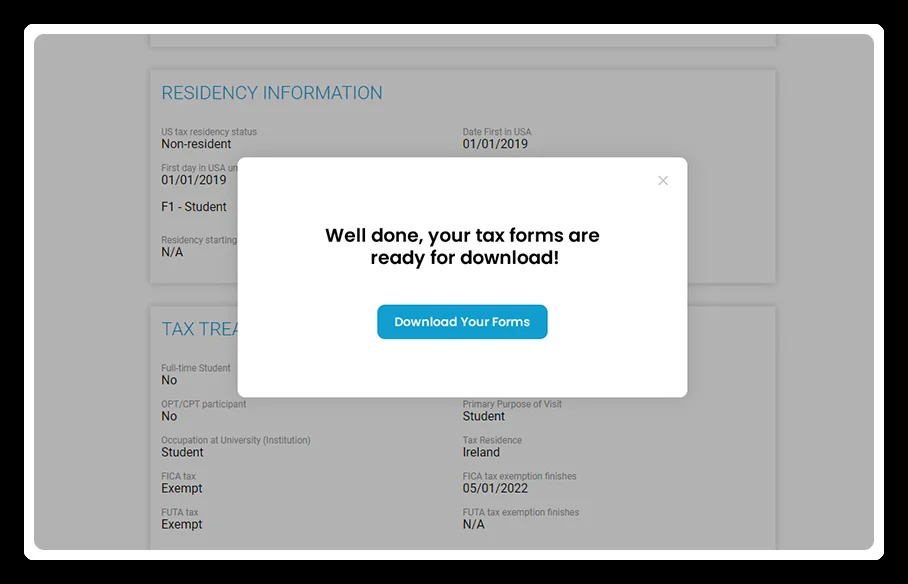

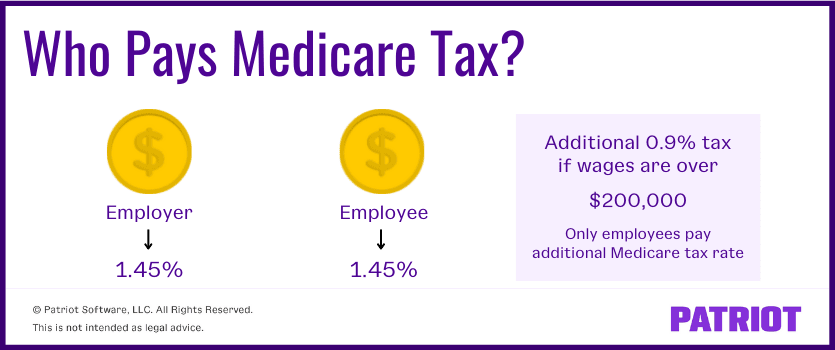

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

1040nra Delaware City DE

What tax forms I have to submit as an OPT student who will be

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Maintaining F-1 and J-1 Status - UCF Global

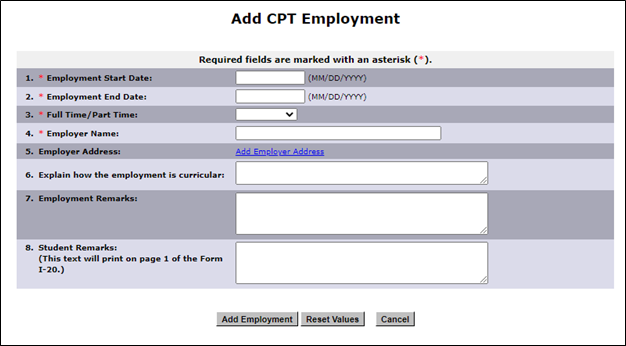

How to fill out your tax forms for a new job on CPT/OPT online

US Taxes for International Students - International Services

CPT, OPT, On-Campus Employment Explained

F-1 Curricular Practical Training (CPT)

US Tax Return & Filing Guide for International F1 Students [2021

1040nra Delaware City DE

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog03 junho 2024

-

What Is FICA Tax: How It Works And Why You Pay03 junho 2024

What Is FICA Tax: How It Works And Why You Pay03 junho 2024 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays03 junho 2024

Federal Insurance Contributions Act (FICA): What It Is, Who Pays03 junho 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes03 junho 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes03 junho 2024 -

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software03 junho 2024

FICA Tax Tip Credit for Salons & Spas - Rosy Salon Software03 junho 2024 -

What Is FICA Tax? —03 junho 2024

What Is FICA Tax? —03 junho 2024 -

What Are FICA Taxes And Why Do They Matter? - Quikaid03 junho 2024

What Are FICA Taxes And Why Do They Matter? - Quikaid03 junho 2024 -

Vola03 junho 2024

Vola03 junho 2024 -

What Eliminating FICA Tax Means for Your Retirement03 junho 2024

-

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax03 junho 2024

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax03 junho 2024

você pode gostar

-

PSI World: Underground Railroad03 junho 2024

PSI World: Underground Railroad03 junho 2024 -

Every Main Character In Cobra Kai Season 5 Ranked Worst To Best03 junho 2024

Every Main Character In Cobra Kai Season 5 Ranked Worst To Best03 junho 2024 -

Google Maps Snakes Game, For April Fools' Day, you can play the train version of the classic Snake game on Google Maps! By Digital Addicts03 junho 2024

-

¿Cuando Se Estrenará La Temporada 2 De Mirai Nikki?03 junho 2024

¿Cuando Se Estrenará La Temporada 2 De Mirai Nikki?03 junho 2024 -

Categoria:Acessórios de cabelo, Roblox Wiki03 junho 2024

Categoria:Acessórios de cabelo, Roblox Wiki03 junho 2024 -

Dave & Buster's on X: Download our Charging Station App to get $20 FREE game play (with $20 Game Plan purchase) Download now: / X03 junho 2024

Dave & Buster's on X: Download our Charging Station App to get $20 FREE game play (with $20 Game Plan purchase) Download now: / X03 junho 2024 -

After ditching Henry Cavill's Superman, can James Gunn really turn03 junho 2024

After ditching Henry Cavill's Superman, can James Gunn really turn03 junho 2024 -

Novos pokémons e Módulos Atrair chegam a Pokémon GO03 junho 2024

Novos pokémons e Módulos Atrair chegam a Pokémon GO03 junho 2024 -

T Shirt - Roblox Muscle T Shirt Template PNG Transparent With Clear Background ID 16389103 junho 2024

T Shirt - Roblox Muscle T Shirt Template PNG Transparent With Clear Background ID 16389103 junho 2024 -

Meu SEGREDO pra pegar MUITO SHINY no POKÉMON GO em 2022! (MELHOR MÉTODO E ATUALIZADO)03 junho 2024

Meu SEGREDO pra pegar MUITO SHINY no POKÉMON GO em 2022! (MELHOR MÉTODO E ATUALIZADO)03 junho 2024