Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 04 novembro 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

FICA Tax & Who Pays It

Understanding payroll tax & how to calculate it

fica tax - FasterCapital

Credit for Employer Social Security and

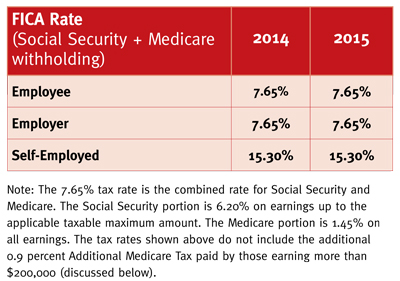

New Rules and Regulations for 2015 Payroll Taxes

2020 Payroll Taxes Will Hit Higher Incomes

New 2024 Social Security, FICA and Medicare Tax Update - Ineo Site

Family Finance Favs: Don't Leave Teens Wondering What The FICA?

What is FICA and why does it matter for Social Security, Medicare

What Is FICA Tax? A Complete Guide for Small Businesses

Social Security Administration's Master Earnings File: Background

Fixing Social Security and Medicare: Where the Parties Stand - The

Employers responsibility for FICA payroll taxes

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

Recomendado para você

-

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays04 novembro 2024

Federal Insurance Contributions Act (FICA): What It Is, Who Pays04 novembro 2024 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202304 novembro 2024

FICA Tax: 4 Steps to Calculating FICA Tax in 202304 novembro 2024 -

What Is the FICA Tax and Why Does It Exist? - TheStreet04 novembro 2024

What Is the FICA Tax and Why Does It Exist? - TheStreet04 novembro 2024 -

FICA Tax: Understanding Social Security and Medicare Taxes04 novembro 2024

-

What is the FICA Tax? - 2023 - Robinhood04 novembro 2024

-

What is a payroll tax?, Payroll tax definition, types, and employer obligations04 novembro 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations04 novembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know04 novembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know04 novembro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine04 novembro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine04 novembro 2024 -

Understanding FICA Taxes and Wage Base Limit04 novembro 2024

Understanding FICA Taxes and Wage Base Limit04 novembro 2024 -

FICA Tax - An Explanation - RMS Accounting04 novembro 2024

FICA Tax - An Explanation - RMS Accounting04 novembro 2024

você pode gostar

-

Shiny 6IV Ditto / Pokemon Scarlet and Violet / 6IV Pokemon / Shiny Pokemon / Breeding Ditto04 novembro 2024

Shiny 6IV Ditto / Pokemon Scarlet and Violet / 6IV Pokemon / Shiny Pokemon / Breeding Ditto04 novembro 2024 -

Vampire Hunter D: Bloodlust review04 novembro 2024

Vampire Hunter D: Bloodlust review04 novembro 2024 -

Guia da Partida – Vasco da Gama x Cruzeiro – Campeonato Brasileiro 2021 – Vasco da Gama04 novembro 2024

Guia da Partida – Vasco da Gama x Cruzeiro – Campeonato Brasileiro 2021 – Vasco da Gama04 novembro 2024 -

how to get blue fist in project slayer|TikTok Search04 novembro 2024

-

Clutches meaning in bengali / Clutches শব্দের বাংলা04 novembro 2024

Clutches meaning in bengali / Clutches শব্দের বাংলা04 novembro 2024 -

Gírias da internet em inglês #ingles #english #idiomas #educação #educ04 novembro 2024

-

Mega Man Maverick Hunter X (PSP) trouxe uma ótima reimaginação da04 novembro 2024

Mega Man Maverick Hunter X (PSP) trouxe uma ótima reimaginação da04 novembro 2024 -

Myths of Greece and Rome, narrated with special reference to literature and art04 novembro 2024

-

Can You Play Retro Games Online? - 16 Bit Review04 novembro 2024

Can You Play Retro Games Online? - 16 Bit Review04 novembro 2024 -

MediaMarkt Rue Neuve/Nieuwstraat04 novembro 2024